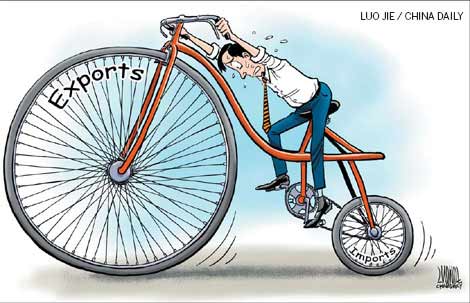

Time to fine-tune strategies, boost imports

Updated: 2011-07-01 10:41

By Li Jian (China Daily)

Chinese companies should adjust local business plans to cope with competition from foreign firms

|

|

Deep-seated structural problems in the process of economic globalization were the main trigger for the international financial crisis of 2008.

The financial systems of most nations were running without any supervision, while households and governments were reeling from deficits without a strong backup from the real economy. It was also the time to take a break from the voracious consumption fueled by spending borrowed money.

These structural problems are by no means over yet as it will take some time before nations can find an answer to all these problems.

One thing that is important for nations to remember while reshaping the financial landscape is to ensure that there is good coordination and cooperation between the deficit and the surplus nations and among the net debtors and net creditors.

It is important that deficit nations must enhance the competitiveness of their exports, while surplus nations must actively spur domestic demand.

However, constrained by domestic factors such as elections, political leaders of major powers shy away from the systemic issues and try to pin the blame on their foreign trading partners.

To some extent this looks like a return to the protectionist policies of the past. The main approach often in these cases is to pressure the trading partner's currency and create trade barriers for imports. The justification for such actions is often the argument that it was necessary to protect domestic products and employment.

But what these nations do not realize is that such approaches will neither change the deficit or surplus situation, nor cure the maladies of globalization. It can only lead to more trade wars and lead to a fundamental reversal of economic globalization.

These actions, if left unchecked, will inevitably interfere with or even ruin the global economy and world trade, which has just begun to show green shoots of recovery after a long hiatus.

During its 30 years of reform and opening-up, China has actively participated in the international division of labor and grown from being a small trading nation to the world's second-largest economy.

China is also one of the biggest beneficiaries of globalization. But the international community has often criticized China's growing trade surplus by saying that the nation was pursuing mercantilist policies.

There are also some in China who argue that trade surplus is important as the net export figures is a positive trigger for gross domestic product (GDP) growth. But after the financial crisis, China's foreign trade surplus has risen sharply and so also has the "mercantilist" campaign claims by foreign nations.

But the real truth is that the Chinese government has come out with a series of measures that aim to readjust economic development and actively expand its imports to achieve a trade balance.

In order to tackle the negative influence of the global financial crisis, China also adopted a 4 trillion yuan (427 billion euros) economic stimulus plan to expand its domestic demand. Such an approach also helped trigger a global economic rebound.

The degree of openness in China is fast expanding. If the mercantilism and protectionism are spreading, then China itself should be one of its biggest victims. The reality is that China is now more keen than ever and willing to join hands with other nations to prevent mercantilism and protectionism.

Needless to say, the long-term trade surplus has helped bolster China's international balance of payments, boosted its GDP growth and provided more employment opportunities to migrant workers.

But the trade surplus has continued for nearly two decades and will lead to a situation where economic growth is far too reliant on external demand, resulting in low yields from exports. Such a situation will add more pressure for yuan appreciation and increase trade frictions with major partners.

I have worked in the United States and New Zealand for some time. The two countries are long-term deficit countries. They attach great importance to developing export markets as their exports help in maintaining GDP growth and boosting employment.

At the same time, the domestic markets in these nations are quite open. Their growth of imports has been faster than the growth of exports. Large-scale imports of foreign products did not affect the economic growth of these nations, their employment or exports, because the competition from imported products had triggered the less-advantaged industry to shift to new industries.

This has given birth to the development of new industries, and it also promoted the upgrading and restructuring of some traditional export-oriented industries.

Purchasing power has improved and people in these nations can now buy more foreign goods at cheaper prices. These nations are also able to lessen the upward pressure on cost growth and inflation.

If you see the economic growth, employment and trade balance situation by comparing the key members in the Organization of Economic Cooperation and Development (OECD), you will find there is no necessary link between a country's economic growth, employment and a country's trade surplus or deficit situation. As long as imports are reasonable and effective, the surplus will not affect national economic development.

In the past, China did implement export-oriented policies. There are four reasons for this. One is to create more foreign exchange; the second is to protect and develop domestic industries that are in their infancy; the third is to increase domestic employment; and the fourth is the concern that over-reliance on foreign supply of goods will affect national economic security.

China has become a big manufacturing country and trading power with a strong competitive advantage in the labor-intensive manufactured industries. Foreign exchange is no longer a scarce resource.

Globalization has increased the degree of interdependence between nations. In order to promote the development of domestic industries and increase employment, the most important principle is to follow the rules of market economy by creating a level playing field.

In recent years, China has maintained a rapid growth of imports. This has shown that China, as a big market with 1.3 billion people, will have a huge demand for imported goods as the economic development has improved living standards of the people.

China has accelerated the country's process of industrialization and urbanization with its fast expansion, especially in heavy industries. This will boost demand for resources, energy and various other raw materials.

According to Customs data, in recent years, there is a growing trade deficit for chemicals products and other related industrial products. China will import more of these products in the near future to correct the imbalance.

China's overall investment environment is improving. Enterprises' demand for foreign advanced technology, equipment and other investment goods is also getting stronger.

With the improved living standards and the enlargement of high-income groups, the domestic high-end consumers will increasingly demand more luxury goods and seek diversity in high-end products. Domestic production can no longer satisfy such needs.

China used to impose higher import taxes to curb the import of such goods in the past. But in the future, these products will have great growth potential.

China is densely populated with limited water resources. There is no advantage for China to develop agricultural sector.

The nation used to emphasize the protection of the interests of farmers, while limiting imports of agriculture products. Now, the more urgent task is to save resources and protect the environment. Economic development is now keeping pace with industrialization and agricultural restructuring is inevitable in the long run.

So there is a big growth potential for China's imports. While many foreign companies are eager to market their goods to China, local companies should actively adjust their business strategy to cope with the new situation.

The author is a researcher with the Chinese Academy of International Trade and Economic Cooperation.

E-paper

Shining through

Chinese fireworks overcome cloudy times, pin hopes on burgeoning domestic demand

Pen mightier than the sword

Stroke of luck

Romance by the sea

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city