Support and suggestions for Lagarde

Updated: 2011-07-01 10:41

By Chen Weihua (China Daily European Weekly)

Despite the widespread call from emerging economies for their candidate to head the International Monetary Fund (IMF), the fund announced on June 28 that Christine Lagarde, the first woman named to the top IMF post, will start her five-year term from July 5.

|

|

China's central bank governor Zhou Xiaochuan, who was in Europe with Premier Wen Jiabao, said in London on June 27 that China has already expressed "quite full support" for Lagarde's candidacy.

While, the United States, which chose this time to wait for the rest of the world to make their decisions first, expressed its support of Christine Lagarde in a written statement by Treasury Secretary Timothy Geithner, hours before the IMF announcement.

The US holds about 17 percent of the voting rights in the 187-nation fund, by far the largest for one country. Japan ranks second, China third. Europe, as a whole, has 32 percent of the voting block.

Lagarde's only contender for the post of managing director, Mexico's Agustin Carstens, had secured endorsements only from Canada, Australia and most Latin American countries except for Brazil and Argentina. Carstens is governor of Mexico's central bank and is a former deputy managing director of IMF.

Sebastian Mallaby, director of the Maurice R. Greenberg Center for Geoeconomic Studies and the Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations, has earlier advocated for a candidate from the developing countries.

"I believe it would have been better for the IMF to select a managing director from outside Europe," he says. "That said, I think Christine Lagarde will do her best to earn the support of emerging economies by listening to their concerns and increasing their voice within the fund."

Edwin Truman, senior fellow at Peterson Institute for International Economics, says he is sure Lagarde will try to address the concerns of emerging market economies.

Truman, the former assistant secretary of the US treasury for International Affairs from 1998 to 2001, still believes that Carstens is probably the best qualified candidate from an emerging market that is likely to be put forward for at least the next 10 years.

Steven Dunaway, adjunct senior fellow for international economics at the Council on Foreign Relations and former deputy director of the IMF's Asia and Pacific Department, says Lagarde faces three major challenges as IMF chief.

"She has to show that the IMF will not simply be a convenient source of funding to help Europe finance the efforts to deal with its debt crisis and that she will cut off IMF lending if European countries fail to consistently meet the conditions in their loan programs."

Lagarde also needs to give emerging market countries more votes and board representation to reflect their growing importance, Dunaway says. She also "has to demonstrate that she can effectively manage the work of the IMF, especially given her limited formal training in economics".

Mallaby says Lagarde's priority is clearly the euro crisis. Dani Rodrik, professor of international political economy at Harvard Kennedy School, agrees, but says: "Beyond that, we need a new framework for global financial flows and regulation, and she needs to do a lot of hard thinking on that. We certainly cannot keep going with a major financial crisis every decade or so."

Eswar Prasad, a professor at Cornell University and former head of IMF's China Division and Research Department, says Lagarde needs to be thorough and quick in shifting voting shares and board representation toward emerging markets.

They were agreed upon under her predecessor's term, he says.

"Lagarde takes over an institution that has become central to the global financial system. The way she manages the political, technical and strategic aspects of the job will help determine the fund's legitimacy and effectiveness," Prasad says.

Allan Meltzer, professor of political economy at Carnegie Mellon University's Tepper School of Business, says: "The IMF should avoid further entanglement in ECB (European Central Bank) problems ... Putting in more money from China, Japan, the US and others is a waste because more debt will not prevent ultimate default by Greece."

While some experts have argued for a reduced function for IMF, Truman believes it has proved its worth time and again over the past 40 years.

"There is no alternative to the IMF at present. We just need to make it work better," Rodrik says.

E-paper

Franchise heat

Foreign companies see huge opportunities for business

Preview of the coming issue

Stitched up for success

The king's speech

Specials

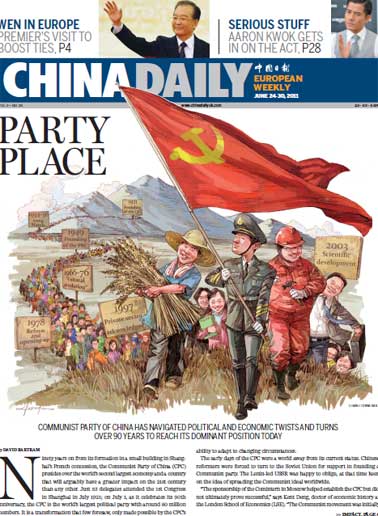

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

Premier Wen's European Visit

Premier Wen visits Hungary, Britain and Germany June 24-28.

My China story

Foreign readers are invited to share your China stories.