Behind Ordos' boom

Updated: 2011-06-10 12:08

By Li Xiang (China Daily European Weekly)

"We want to turn the lenders of high-interest loans into LPs. We hope to attract PE funds from across the country to register and open offices in Ordos, and to establish joint-venture companies with local entrepreneurs," he says.

However, for local fund managers, this is easier said than done. In order to make PE funds attractive to the local rich, they have to ensure that their investments outperform the high returns generated by extending private loans.

"It means that we have to promise at least 30 percent return annually and the investment cycle has to be short," says Fang Yongfei, vice-general manager of the Ordos-based Xinze Private Equity Investment Fund.

It usually takes five to seven years for a PE fund to exit its investment portfolio, but the cash-seeking rich have little patience for long-term investments because they are used to quick profits and want to see immediate returns, Fang says. "Good LPs are hard to find and it is difficult to convince them that investing in PE funds is better than offering high-interest loans," he says.

Fang's fund managed to raise 150 million yuan in the first phase of funding, with the initial partners all being acquaintances or business partners. But finding good deals is even harder than finding good LPs. Unlike some coastal Chinese cities, Ordos does not have an active IPO market where PE funds can exit their investments. There are not as many high-tech companies as in Beijing or Shenzhen that are able to list on the country's start-up board.

The most profitable enterprises in Ordos are coal companies that are rarely short of cash and have little desire to raise capital by listing on the stock market. It has also become difficult for cash-strapped property developers to go public because they are subject to strict regulatory approval while Beijing is taking measures to cool the market.

|

|

|

|

|

|

"We have to go outside Ordos to find good deals. The competition among PE firms is very intense," Fang says.

He adds that his fund has hired lawyers, accountants, and brokers in cities such as Beijing and Shanghai to help discover investment opportunities.

The fund has recently reached a tentative agreement with the aforementioned manufacturer of railway equipment in Shandong province for investment of 80 million yuan. Fang has high hopes for the deal, because once the company is listed, his fund is likely to pocket at least a 10-fold return.

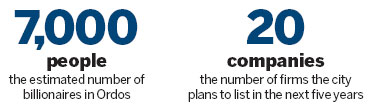

To build the momentum of PE investment, the local government plans to list 20 companies in the next five years and will prepare at least 50 more for future IPOs. It has also enacted a raft of policies to subsidize the IPO expenditures of enterprises to reduce the cost of listing.

|

|

Philosophy is key

However, whether the new policies will help to allay the problem of rampant illegal fundraising in Ordos remains to be seen. Few PE firms are enthusiastic about opening offices there, despite the city's large capital base and favorable government policies.

"The key for a successful deal is that the investors and the managers share the same investment philosophy," says Yi Jigang, president of Orient Jiyi Investment, a Beijing-based PE firm.

"It could be difficult for PE funds to operate if the investors are only attracted to quick profits," he says. "It takes time to educate investors and cultivate the culture of PE investment. At present, we have no intention of setting up a fund in Ordos."

Establishing PE funds in the city is a difficult process, but Fang remains optimistic about their future in Ordos. He hopes the funds will replace private lending as a major method for private companies to raise capital.

"The cheap capital from banks has long been exhausted by the State-owned enterprises, and it is difficult for small enterprises to raise funds in the stock market as well because IPOs are controlled by the regulator," he says.

"Therefore, China's private enterprises, which contributed approximately 70 percent of the country's GDP last year, are forced to borrow at a much higher cost," he says. "Private-equity investment should gradually replace high-interest loans as the major source of financing for smaller private enterprises."

Feng Pengcheng, a professor at the University of International Business and Economics in Beijing, says that besides encouraging PE investments, the government should also support the development of small-loan companies, rural banks, and other financial institutions to better regulate the massive amount of private capital.

"It is only by granting private capital authorized status and allowing it to participate in the formal financial institutions that the government will be better able to regulate the sector," he says.

E-paper

Ringing success

Domestic firms make hay as shopping spree by middle class consumers keeps cash registers ringing in Nanjing

Mixed Results

Crowning achievement

Living happily ever after

Specials

Ciao, Yao

Yao Ming announced his retirement from basketball, staging an emotional end to a glorious career.

Going the distance

British fitness coach comes to terms with tragedy through life changes

Turning up the heat

Traditional Chinese medicine using moxa, or mugwort herb, is once again becoming fashionable