European auto talent heads for China

Updated: 2011-06-10 10:26

By Wang Chao (China Daily European Weekly)

|

|

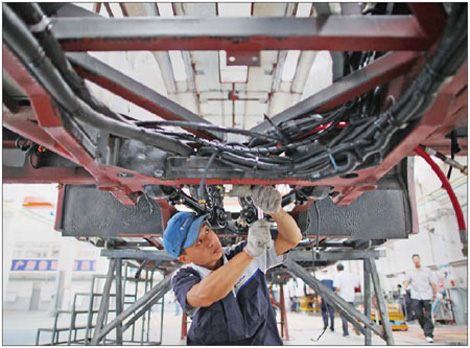

A worker assembles a hybrid bus at a BAIC factory in Beijing. The automaker has recruited 39 Europeans in a recent headhunting tour to Germany. Provided to China Daily |

Local companies fill up vacancies with overseas recruitment

After snapping up iconic global automobile brands, Chinese automakers are now turning to Europe for their middle and higher-end human resource (HR) requirements, even as they expand aggressively in the world's largest automobile market.

Aside of the severe domestic talent crunch, what is prompting automakers to look abroad for manpower requirements is the fact that cross-border mergers and acquisitions are now becoming commonplace in China. With manufacturing of most brands now moving to China, there is just not enough experienced talent to man the factories.

But for several other HR managers like Gao Yuan, Europe has been the answer to most of their problems.

|

As the HR director of Beijing Automobile Industry Co Ltd (BAIC), Gao was finding it difficult to fill up several key positions in the factories due to unavailability of experienced talent.

But recently he has managed to recruit 39 Europeans, including several native Germans, to work in China during a recent headhunting tour to Germany.

"This is the first time that a Chinese auto company has undertaken such recruiting events in Europe," Gao says.

BAIC is one of the top four State-owned automakers in China. In 2010, its profit reached a record 10 billion yuan (1.07 billion euros).

After expanding aggressively during the past three years, BAIC will have an annual production capacity of over 2 million units this year.

But the company is also facing a severe shortage of talent.

Its subsidiaries all over the country are waiting to fill up several key positions, prominent among them being the Beijing Mercedes-Benz factory for engines and the under construction Hyundai factory.

BAIC's own brand "Beijing" is desperately short of technicians and managers, while several vacancies exist in its units outside of Beijing.

But BAIC is not the only company facing a talent famine.

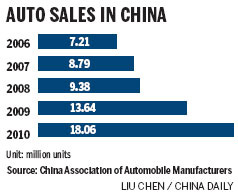

Since 2009, China's auto market has been growing at nearly 20 percent, and clocked annual sales of around 18 million units in 2010, making it the largest auto market in the world.

But the lack of high-quality auto talent, especially technicians and managers, is stifling the growth prospects of automakers.

Zhang Xiaoyu, vice-president of China Machinery Industry Federation, says the auto talent shortage in China is "not just a few", but "measured by millions". Fu Yuwu, secretary-general of the Society of Automotive Engineers of China, says that other than engineers, there are several key "blue-collar" positions that need to be filled up.

In spite of having foreign joint venture partners, the talent shortage persists in the Chinese auto sector. Though Chinese auto companies opened the doors to joint venture partners from Europe, the United States and Japan in the 1980s, they did not get much of the core technologies and were just assembling units for foreign brands.

Unlike the textile and toy industries that require little expertise, the auto industry is comprised of complex processes, and it takes years to train a skilled worker.

To cope with this problem, companies came up with different solutions.

Geely, one of the biggest auto brands in China, established the "Geely University", to train its employees. However, this training cannot substitute real world experiences, especially international merger and acquisition expertise.

Some companies chose to stay on and fight for the limited available domestic talent, especially among the recent overseas auto-returnees.

Wang Dazong, senior engineer of General Motors who worked in Detroit for 22 years, was recruited by the Shanghai Automobiles Industry Co Ltd (SAIC) in 2006. Two years later, he was hired by BAIC as its general manager.

Han Yonggui, president of BAIC, says with overseas M&As gaining further momentum, the demand for overseas talent will zoom.

"We need more talent especially those who are good in financing and foreign languages," he says, adding that his company is planning to acquire a foreign component parts company.

During the last five years, BAIC has recruited more than 160 employees from overseas. This year it plans to hire more than 50 senior talents to work in its original equipment manufacture (OEM) and new energy car departments.

"We took another approach by introducing fresh blood from Europe, as the region has the best engineering programs and the best cluster of auto companies," Gao says.

During the recent five-day recruitment drive in Europe, the company received applications from nearly 340 applicants. Most of them were engineering graduates and experienced auto technicians; and after several rounds of interviews, 39 were invited to join the company.

"Even we are surprised at how enthusiastic the Europeans are to work in Chinese auto firms," Gao says.

He and his colleagues expected to see several black-hair and black-eyed Chinese expatriates for the interviews, but were surprised by the presence of over 30 blond Germans.

A young German engineer, who did not want to reveal his name, says that he became aware of the recruitment drive through a Chinese friend. Graduating from Dortmund University, a school famous for its engineering program, he has been doing his internship in Bosch for one year.

Much to the surprise of HR mangers like Gao, the disparity of salaries between China and Germany was not a major deciding factor for the applicants.

"In Germany, the average salary for new engineering graduates is 38,000 euros to 45,000 euros, and even higher for senior auto engineers; but in China auto companies can hardly afford this number."

Gao says foreign applicants are more concerned about how their career paths would evolve in China over the long term.

"They are fully aware that we cannot offer the same salary, but are really keen on working here."

China's auto market has grown exponentially at an annual rate of 20 percent in the past few years. In contrast, the growth in the Western markets has been sluggish.

Carlos Ghosn, chief executive of French carmaker Renault SA, predicts that the European auto market will shrink by at least 2 percent in 2011, even as sales dipped by 7 percent in 2010.

Figures released by CRCC Asia, a recruitment consultancy, shows that China is becoming an increasingly popular destination for overseas talent - beyond the auto industry - for internship and long-term jobs.

"The Chinese economy is booming and it's very appealing for graduates to get an insight as to why that's happening by visiting the country. With the bleak job market in the UK and the US, China offers a great opportunity to get a long-term career," CRCC Asia Director Daniel Nivern told the Wall Street Journal in a recent interview.

E-paper

Pret-a-design

China is taking bigger strides to become a force in fashion.

Lasting Spirit

Running with the Beijingers

A twist in the tale

Specials

My China story

Foreign readers are invited to share your China stories.

Mom’s the word

Italian expat struggles with learning English and experiences the joys of motherhood again.

Lenovo's challenge

Computer maker takes on iconic brand apple with range of stylish, popular products