The China Opening

Updated: 2011-06-10 10:25

By Andrew Moody (China Daily European Weekly)

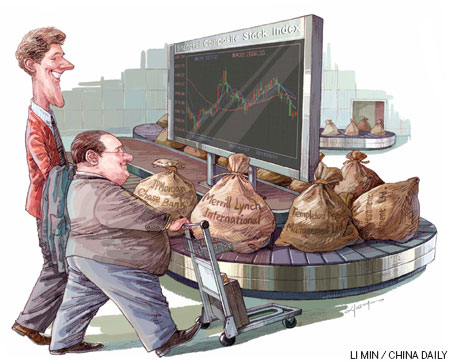

Financial sector reforms set to open up China's capital markets for more foreign investment

|

||||

Shanghai might be the world's fifth-largest stock exchange but foreigners are denied open access to it and its sister exchange in Shenzhen.

China equity funds run by the major European and foreign investment houses typically can only get a piece of the China success story by investing in Chinese companies like China Mobile and PetroChina that also have a listing on the Hong Kong stock exchange.

A measure of the restricted access is that while the mainland equities make up around 10 percent of the global equity market by value (or market capitalization) they make up just 3 percent of the global benchmark indices.

Things are happening, however, that suggest a mood of liberalization. The Chinese authorities have signaled they may give the go ahead as early as later this month for foreign companies such as Coca-Cola and European corporations like Unilever and HSBC to list in the mainland.

Over the past year, there has also been an extraordinary build up in the amount of yuan deposits held by Hong Kong banks from 90 billion yuan (9.5 billion euros) last July to 510 billion yuan, some of which is looking for yuan-denominated investments such as China equities.

Aaron Boesky, chief executive officer of Marco Polo Pure Asset Management, based in The Centrium, a skyscraper situated on a high slope in Hong Kong's Central Business District, believes China's stock markets could be open to foreign investors in just over three years.

"The wall is coming down and by 2015 QFII (the qualified foreign institutional investor scheme which currently rations access to the China equity market) will likely be finished and the A-share (China yuan-denominated listed shares) market will generally be wide open," he says.

E-paper

Harbin-ger of change

Old industrial center looks to innovation to move up the value chain

Preview of the coming issue

Chemical attraction

The reel Mao

Specials

Vice-President visits Italy

The visit is expected to lend new impetus to Sino-Italian relations.

Birthday a new 'starting point'

China's national English language newspaper aims for a top-notch international all-media group.

Sky is the limit

Chinese tycoon conjures up green dreams in Europe with solar panels