Possible deal gives Saab a lifeline

Updated: 2011-05-20 11:03

By Lin Jing (China Daily European Weekly)

|

|

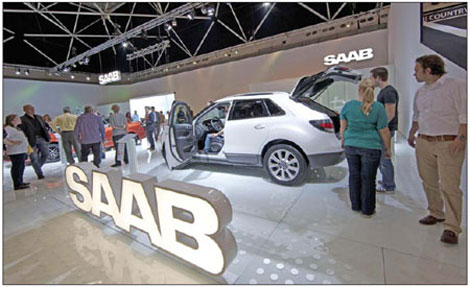

The latest mid-size SUV crossover Saab 9-4X is displayed at the RAI auto show in April in Amsterdam, Netherlands. Spyker Cars NV got a financial boost from Pangda after it agreed to buy a 24-percent stake in the cash-strapped company. Provided to China Daily |

Auto dealer to inject much-needed funds into Swedish brand

Four days after a deal collapsed with Hawtai Motor Group, Spyker Cars NV announced on May 16 that Chinese auto dealer Pangda Automobile Trade agreed to invest in the owner of the Swedish brand Saab.

The two companies have signed a memorandum of understanding (MOU) in which Pangda agreed to pay 65 million euros for a 24 percent equity stake in Spyker.

Pangda will also purchase an unspecified number of Saab vehicles for 30 million euros, and may make an extra conditional payment for more vehicles for 15 million euros within 30 days.

The deal also mentions possible joint ventures between the two companies in vehicle manufacturing and distribution in China, both under the Saab brand and a new brand.

Pangda is one of the largest Chinese car distributors, operating about 1,200 dealerships in the country. The recent debut of its IPO on the Shanghai stock market raised 1 billion yuan (108 million euros).

But Jia Xinguang, an auto analyst based in Beijing, says it will be difficult for Pangda to get the necessary government approvals.

"The cooperation is involved in too many complicated issues," Jia says.

"Pangda is only a car distributor. The transition from a car distributor to a manufacturer and the establishment of a car manufacturing joint venture both need regulatory approvals. The process will not be that smooth."

Saab has faced difficult times in the past decade and the brand has lost its growth engine, Jia says.

"Saab entered into the Chinese market many years ago and did not have a satisfactory sales record. So it is still unpredictable whether this cooperation will bring any benefits to Pangda or not."

Shen Zhengyuan, a transportation analyst with CIConsulting, says that what Spyker needs is sufficient funding from Pangda to sustain Saab's development.

"Spyker has been looking for a partner in China. It is trying to solve its financing problem with help from Chinese enterprises," Shen says.

Shen says that, in the short term, the MOU will be mutually beneficial.

"Spyker might fix the financing issue for Saab temporarily if Pangda becomes its shareholder, and Pangda could also increase its sales with Saab vehicles and pave its way into the auto manufacturing industry," Shen says.

"But in the long run, it is still a question mark - whether Pangda can revitalize Saab with Chinese capital."

Shen says that the market is also not optimistic about this cooperation because of the high feasibility risk.

"By accepting the offer from Spyker, Pangda is also taking over the potential risks. Besides, the deal is only an MOU, not an official agreement. On the whole, there is still great uncertainty in this cooperation."

However, a number of analysts are optimistic about the partnership. "The Saab-Pangda deal will be a great success," says Ash Sutcliffe, business development director of Automotive PR China and editor of China Car Times.

"Pangda's plan is quite simple, they plan to buy the production that Saab currently has in stock or is planning to make over the next few months and sell them in China. This deal is unlikely to need any extraordinary government approval as it falls in with Pangda's usual business scope," he says.

The deal should assist Saab considerably in the short term and will help regain confidence, Sutcliffe says. It will also reduce the pressures on Saab's supply chain network.

Sutcliffe says that though Pangda does not have any car-making experience, another of its partners, Beijing Auto Industry Corporation (BAIC), will take over the baton.

"BAIC and Pangda recently signed up to create a joint venture that would see them each as 50 percent stakeholders," he says.

BAIC, which already has a limited amount of Saab production technology, has been creating its own brand based on the last generation Saab 9-3 and Saab 9-5 platforms, Sutcliffe says.

"What they want is Saab, but what they don't have the ability to do is set up a nationwide Saab dealership network within the year; this is Pangda's forte; BAIC's, of course, being making cars."

The Chinese luxury car market is growing rapidly and Saab needs to be part of it in order to survive, he says.

"With the assistance of BAIC and Pangda, Saab cannot fail to cash in on the booming Chinese market," he says. "Pangda's purchasing of Saab's stock and immediate production run will take the pressure off. But a factory in China is the ultimate path to riches and hopefully glory for the Swedish brand."

E-paper

Pearl paradise

Dreams of a 'crazy' man turned out to be a real pearler for city

Literary beacon

Venice of china

Up to the mark

Specials

Power of profit

Western companies can learn from management practices of firms in emerging economies

Foreign-friendly skies

About a year ago, 48-year-old Roy Weinberg gave up his job with US Airways, moved to Shanghai and became a captain for China's Spring Airlines.

Plows, tough guys and real men

在这个时代,怎样才"够男人"? On the character "Man"