Exchange runs into bubble trouble

Updated: 2011-04-08 06:49

By Li Jing (China Daily European Weekly)

What is the easiest way to boost the price of a painting? The answer, at least in China, is probably by listing the artwork on an art exchange where its shares are traded.

That's what happened to two paintings - Roaring Yellow River (Huang He Pao Xiao) and Autumn in Fortress (Yan Sai Qiu) - on the Tianjin Cultural Artwork Exchange.

|

Visitors at the Tianjin Cultural Artwork Exchange look at Bai Gengyan's painting Autumn in Fortress. [Photos by Wang Huan/ for China Daily] |

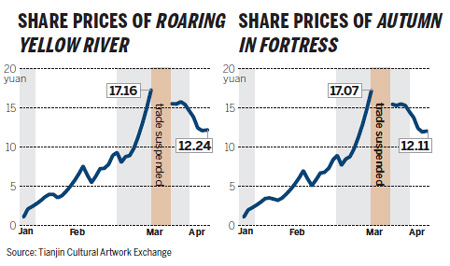

Since the initial offerings in January, shares in each of the two paintings soared to 18 times the opening price by mid-March, when regulators suspended trading for five days after excessive speculation.

A string of revisions to the exchange's trading rules caused prices to plunge, but shares of Roaring Yellow River traded at 12.24 yuan ($1.84) on April 7, compared with the issue price of 1 yuan. That put the value of the artwork, painted in 2000, at 73.34 million yuan.

Shares of Autumn in Fortress, painted in 2005, closed at 12.11 yuan on the same day, for a value of 60.55 million yuan.

|

An employee of the Tianjin artwork exchange shows how to do the online trading. |

That gave Shandong-born painter Bai Gengyan, who died in 2007, a sudden rise from obscurity. His best record at public auction stood at 3.92 million yuan.

Both artworks are traditional Chinese landscape paintings, something of Bai's specialty. The exchange keeps confidential any information regarding who actually possesses the paintings, at the owner's request.

While some call this trading a financial innovation for the art market, others worry that such emerging art exchanges in China will lead to just another wave of investment mania following last year's bubbles, and bursts, for garlic, apples and mung beans.

New but not unique

Tianjin Cultural Artwork Exchange (TCAE) did not invent the idea of trading artworks as stocks.

Last year, Shenzhen Artvip Cultural Corp offered to sell 1,000 shares of an art portfolio comprising 12 paintings by contemporary artist Yang Peijiang on the government-sponsored Shenzhen Cultural Assets and Equity Exchange.

|

|

The shares sold out on the first day, reaping 2.4 million yuan.

The Tianjin exchange went a step further by allowing the shares to be traded daily, so the investors could profit from short-term movements in price.

Take Roaring Yellow River, for instance. Two appraisal firms, invited by TCAE, put the value at 6 million yuan, so the exchange divided the painting into 6 million shares, at 1 yuan each, for the initial public offering on Jan 26.

Accredited buyers can open accounts and acquire shares through the online trading platform, which is much like a stock exchange system. TCAE set daily price limits to restrict fluctuation and suspend the market when trading becomes especially volatile.

In addition to paintings, the exchange allows trading of calligraphy, sculpture, artistic handicrafts, jade wares, porcelain, antique furniture and other items after authentication. A pink diamond is the only item being traded now that's not a painting.

"The aim is to associate the art world with the capital market, and boost the co-benefit of cultural and financial industries by attracting more public attention and participation in culture through investment," the Tianjin exchange said on its website.

Though the exchange is privately owned, TCAE said it has won special support from Tianjin municipal government and was listed as one of the city's top 20 projects for financial innovation in 2009. The exchange was registered in September that year, but it took more than a year to start operations.

Not exactly 'stock'

The fledgling idea of an art exchange is difficult to define, even for some veteran art collectors and investors in China.

"Strictly speaking, you cannot call it 'art stock' even though it is traded in a way very similar to the stock market," said Hu Yousheng, general manager of Hai Guo Tou Industry Share Co Ltd, who is also an experienced investor in the art market.

"Stock" refers to a certificate that represents part ownership of a company and the right to receive a share in its profits. Shareholders can make decisions to buy or sell based on the company's performance, he explained to the magazine Weekly on Stocks.

In comparison, the future of any artwork, without a specific index to measure its growth and returns, is more unpredictable and unstable.

"The trading rules set by TCAE, particularly the day-trading part, make the idea extremely appealing to the medium and small investors, especially those who have some experience in the stock market," Hu said.

Other analysts worry that the lack of regulation and supervising bodies, the immature trading rules of such "art stocks", as well as the ambiguity in some valuation processes are extremely conducive to sparking speculation.

Doubts and changes

What's happening to the art stocks traded at TCAE validates such worries. The dramatic swings of the share prices have led to questions whether the trading is manipulated or even a scam.

The price of the two paintings rocketed more than tenfold within six weeks after the shares were issued. The exchange revised its trading rules several times to curb the unbridled investment.

TCAE issued a notice on March 7 saying it would lower daily price limits from 15 percent to 10 percent - meaning that the daily highs and lows could not exceed 10 percent of the opening price - but did not give a specific date on which it would implement the new rule.

Three days later, it raised the threshold for investors to open a trading account from 50,000 yuan to 500,000 yuan.

Neither move seemed effective. Trading of the two paintings was suspended on March 17 following an order from "Tianjin municipal regulatory bodies, in order to reduce the risks and protect the investors' interests", TCAE said on its website.

The exchange declined to say who its supervisor is and turned down all interview requests by news media. Nor does it accept on-the-spot inquiries about trading procedures or the management structure.

When trading of the two paintings resumed on March 24, prices started to drop.

Meanwhile, seven more paintings by Bai were listed on the platform, and all recorded a significant increase in price.

Profit vs. art

Some art critics said that speculation on such obscure paintings would further disturb the already volatile art market in China.

Zhang Zhongyi, vice secretary-general to China Association of Collectors, was quoted by Century Weekly magazine as saying, "Bai's works are not particularly popular at auction houses. The speculation at TCAE has led to severe overvaluation of his paintings. The bubble is already there."

A mature and credible valuation system is still absent, making investors more vulnerable to the potential risks. But several investors admitted they don't really care about the artistic value of Bai's paintings as long as they can profit from the secondary market.

A similar platform in France, the Art Exchange, which opened in January, was the object of remarks more blunt than Zhang's, reported Art+Auction, a New York-based magazine that focuses on investment in art and antiques.

"It's a dumb idea," the magazine quoted New York dealer Christophe van de Weghe as saying. "Their target is people who don't know anything about art and who think of the art world as fancy, exotic and fun."

Sergey Skaterschikov, chief executive officer of Skate's Art Market Research, commented on the potential for manipulation: "There's enough fraud and abuse in the art market already, and it would be very easy to exploit art-backed securities."

Bai's paintings are still being traded in shares at TCAE. But the exchange quit opening new accounts on March 28, without stating the reason or when the service would resume. The fate of Bai's paintings - and that of the investors - is still pending.

A new wave?

Meanwhile, a dozen Chinese cities are preparing for similar art and cultural exchanges. Zhengzhou, capital of Central China's Henan province, plans to launch its own exchange late this month.

Emergence of such art exchanges points to a renewed boom in China's art market. In 2007, a wave of record auction prices for paintings by contemporary Chinese artists flowed around the globe, making some of them best-sellers worldwide almost overnight. Then the global financial crisis hit and, in 2008, the art bubble burst.

China overtook Britain as the world's second biggest market for art and antiques last year, said a report in March from The European Fine Art Fair.

A record auction price for a Chinese contemporary artwork - HK$79.06 million (US$54.8 million) - was set on Sunday at Sotheby's in Hong Kong. Zhang Xiaogang's 1988 work, Forever Lasting Love, a triptych oil painting, shows half-naked figures in an arid landscape surrounded by symbols.

The Chinese government has identified the cultural industries as a new driver for the country's economic growth. The State Council approved the Plan to Adjust and Reinvigorate the Culture Industry in September 2009, making it a national strategic industry.

In the country's 12th Five-Year Plan (2011-2015), the top leaders have set a target to raise the industry's percentage of national economic growth from about 2.5 percent to 5 or 6 percent.

Some experts warn that the push and investment by the government will not be enough to bolster the healthy development of the industries.

Lu Peng, an associate professor at China Academy of Art, said lessons should be learned from the turmoil related to TCAE. "The incident actually reflects that the public lacks the most basic common knowledge of artworks," Lu wrote on his micro blog. "The problem is those investors can't really judge the value. It is not a bad thing if we can take this chance to promote art education among the public."

E-paper

Green light

F1 sponsors expect lucrative returns from Shanghai pit stop

Buying into the romance

Born to fly

Light of hope

Specials

Share your China stories!

Foreign readers are invited to share your China stories.

No more Mr. Bad Guy

Italian actor plans to smash ‘foreign devil’ myth and become the first white kungfu star made in China.

Art auctions

China accounted for 33% of global fine art sales.