Chasing China's new emperors

Updated: 2011-03-18 10:52

By Matt Hodges (China Daily European Weekly)

"He's part of that explosion of new interesting things happening in China, in a relatively free way.

"Ten or 20 years ago, people in the private sector may not have had such great international backgrounds, and may not have been working in tech-related industries, but that's become more and more common now.

"Robin Li is an extremely well-educated engineer. He has international savvy. He's married. He's a family man. What better symbol of the private sector, from an international point of view, than someone like this?"

Li, 42, cut his teeth at Infoseek in Silicon Valley before heading home to launch a business that has so far netted him $9.4 billion, not to mention recognition as the world's 95th richest man (No 1 on the Chinese mainland).

Flannery attributes the jump in the number of Chinese billionaires to a confluence of trends, new and old.

"Stock market valuations have gone up a lot over the last year. Take Baidu, for example. Its stock price doubled over the last year. When you have this happening, together with double-digit growth in a country the size of China, a lot of people are making money.

"There has also been a huge increase in IPOs, making these companies much more transparent and attractive to foreign investors," he says.

"When these companies list, then right away we pick them up on our radar, and we're happy to have them on our list. They've been audited. You have an annual report. And after they've listed, they're often a lot more approachable.

"But the underlying cause is much more long-term. China has been promoting reforms in the private sector for 30 years, and the improvement in the legal structure, and to capital markets for private companies, are just things that have happened little by little and year by year."

Another challenge for Flannery and his team of researchers is trying to stay accurate in a country with such a huge shadow economy and hidden wealth.

Alberto Forchielli, managing partner at Mandarin Capital Partners, says: "According to some, shadow income could amount to up to 15 percent of GDP."

"For sure, there's a lot of gray money in China," Flannery says. "But the trend is toward greater transparency.

"When we're talking about gray money, I think it's very easy to hide a fortune of $10 million, $20 million, or $50 million, but when we're talking about hiding a fortune of more than a billion dollars, or 5 billion, it starts to get pretty hard to hide that," he says.

"If you look back 10 or 20 years, all that kind of illegal activity is now described by the Chinese media as 'original sin', which happened back when the legal system wasn't so clear."

Now the playing field has changed due to the volume of market research being done on Chinese entrepreneurs by foreign companies and Chinese universities, together with all these newly listed companies, he says.

"If you put all those things together, overall, the transparency and the legal framework for private business in China today is probably better than it has ever been."

While property and retail remain strong sources of Chinese billionaires' capital, many of the new-generation tycoons boast surprisingly diversified portfolios.

"Early on there tended to be a relatively large number of people coming onto the list from the real-estate industry, but things have changed quite a bit over the years," Flannery says. "Especially this year, they're really coming from all over the place."

New Huadu Group founder Chen Fashu, who ranks 15th in China and 323rd overall, is a good example. The Fujian province native got his $3.4 billion from investments in mining, beverages and tourism, as well as retail and other businesses. Something of a philanthropist, he later opened a business school in his home province to keep China's billionaire ball rolling.

China's next batch of minted moguls will likely draw from a variety of sources, notably healthcare and leisure, the outbound travel industry, home furnishings - despite the property market slowdown - and retail, as the government encourages consumer spending, he says.

"China's GDP growth still looks pretty good for this year," he says. "It may be a tall order to go up by another 51 people (billionaires), but I think overall the world economic environment is pretty good, and China is working hard to put more resources into innovation and structural change.

"I've been very confident about China's economic prospects for two or three decades now, and I'm not about to change my view."

E-paper

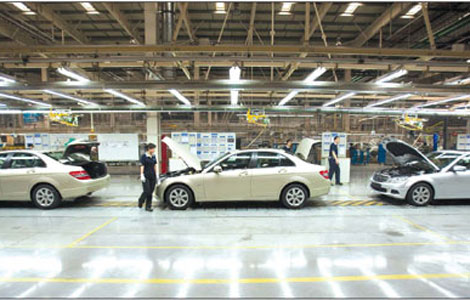

Factory fever

Despite auto manufacturing bubble scare, car giants gear up expansion of factories.

Preview of the coming issue

Dressed for success

Fabric of change

Specials

Earthquake Hits Japan

A massive 8.8 magnitude quake hit the northeast coast of Japan on March 11,2011.

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Slide: Japan quake

Devastating earthquake and tsunami left millions without water, electricity, homes or heat.