It's time for a Beijing Club

Updated: 2011-03-11 10:25

By Ahmed Sule (China Daily European Weekly)

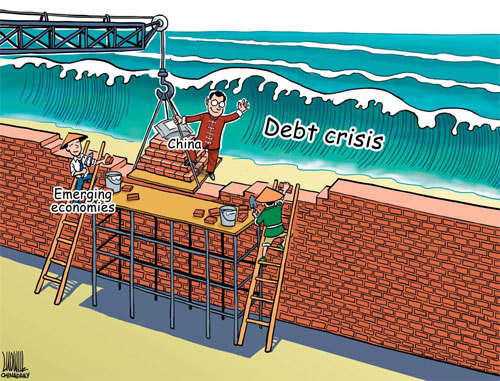

Emerging economies need forum to ensure security of their debt holdings in advanced economies

|

|

In the 1980s and '90s, there was an emerging-market debt crisis resulting partly from excessive and unsustainable borrowing by developing economies. Countries such as Poland, Mexico, Russia, Brazil, Argentina and the Philippines struggled to repay foreign creditors, thereby triggering unemployment, contraction of economic growth and currency devaluation.

The majority of debt incurred by these countries was owed to members of the Paris Club, set up in 1956 as an informal group of official creditors to find coordinated and sustainable solutions to the payment difficulties experienced by developing and emerging debtor countries. The club comprises a number of advanced economies including the United States, the United Kingdom, Germany, Italy, Ireland, Spain, France and Belgium. The Paris Club played an important role in the management and resolution of the debt crisis experienced by emerging economies.

But today, there is a reversal in the economic conditions of the emerging and advanced economies. A number of emerging economies are enjoying improved economic conditions due to prudent economic policies, thereby transforming them from debtor nations to creditor nations. Emerging economies now contribute to a rising share of global GDP and lending. These economies are also characterized by low external debt, rapid economic growth and increasing foreign exchange reserves.

Emerging countries have invested a sizable portion of these foreign exchange reserves in government debt in a number of advanced economies. For instance, China is the largest holder of US Treasury bonds with an investment of $900 billion (644 billion euros). Other emerging economies such as the oil exporting nations or Brazil also have huge exposure to US Treasury bonds and other developed market government bonds. A number of emerging markets have also created sovereign wealth funds (SWFs) to invest the proceeds of their foreign reserves. These SWFs hold billions of dollars in government bonds. Emerging economies account for nine out of the top 10 sovereign wealth funds with total assets under management of around $3.4 trillion as of last year.

Conversely, the majority of advanced economies have seen their once economic dominant position decline in the aftermath of the 2007-2009 financial crisis. Due to flawed economic policies, these economies are experiencing the worst economic climate since the Great Depression as evidenced by widening current account and budget deficits, slow economic growth and unsustainable debt levels by households, corporates and governments. According to McKinsey, as of 2010, the total debt as a percentage of GDP for the UK, Japan, the US and France was 466 percent, 471 percent, 296 percent and 322 percent, respectively, compared to Russia's 71 percent, Brazil's 142 percent, China's 158 percent and India's 129 percent. Furthermore, in 2009, the net sovereign debt to GDP ratio in advanced economies was 70 percent compared to 35 percent for emerging economies.

With advanced economies facing rising sovereign yields, credit downgrades, unsustainable public and private debt and slow economic growth, there is an increased risk of an advanced-economy-debt contagion, which could expose sovereign emerging market creditors to monumental losses. In the aftermath of the financial crisis, a number of emerging markets' SWFs lost sizeable sums of money due to significant exposure to financial services companies in advanced economies. For instance, in 2008, SWFs and foreign-currency funds of the Gulf Cooperation Council lost about $350 billion or 27 percent of their assets.

Following the eurozone crisis, a number of advanced economies are courting emerging economies to invest in their government bonds. In March 2010, Carl Heinz Daube of the German debt management agency met with Chinese and Singaporean officials in an attempt to get the Chinese and Singaporean governments to invest in German government bonds. The Chinese government has also indicated its willingness to support the Greek and Portuguese debt market in addition to pledging to buy more Spanish government bonds.

Analogous to the Paris Club, which has been instrumental in protecting the interests of developed economies against the debt problems of emerging economies, a similar organization is needed to protect sovereign emerging market creditors (SEMCs) from the debt quagmire facing advanced debtor economies. In short, now is the time for the formation of a Beijing Club for sovereign emerging market creditors.

The Beijing Club would be set up as an informal group comprising of SEMC nations that have significant exposure to the public debt of advanced economies. Membership could include countries such as the BRIC economies, major oil exporting nations, Singapore and South Korea.

One main task of the club would be to act as a forum for the resolution, rescheduling and restructuring of official SEMC credits to developed market economies in the wake of a highly probable contagion of advanced economy sovereign debt. However, in its dealings with advanced debtor nations, the Beijing Club should adopt a proactive approach by utilizing crisis prevention strategies as its first line of defense. In the event of an advanced-economy-debt contagion, the club, in conjunction with the IMF, could work out a conditionality-based debt treatment plan for each defaulting nation.

It is imperative for members of the club to be united in its engagement with advanced debtor nations. Furthermore, the club should adopt a consensus-based approach and members should be mandated to abide by the consensus agreed within the club.

One issue that the Beijing Club would need to address as a matter of urgency is the unsustainable and deteriorating fiscal position of the US. Since most members of the Beijing Club are likely to have significant exposure to dollar-denominated assets, the club should use its influence to persuade the US government to implement policies that do not jeopardize its members' interests.

Besides engaging with advanced economy debtor nations, the club could also act as a forum to resolve disputes among SEMC members.

The club could, in conjunction with other institutions, work out a pragmatic approach toward the creation of a global reserve currency to replace the vulnerable dollar. It should also discuss and implement strategies to discourage advanced debtor countries from inflating their way out of debt. This issue is very important as the increasing debt load faced by advanced economies could encourage them to inflate their way out of debt, thereby negatively affecting creditor nations. The club should also seek explanations and assurances from advanced economies that quantitative easing programs will not contribute to serious inflationary pressures.

Since cooperation with the IMF and World Bank is essential for the success of the club, the current quota and governance reforms in these two institutions would need to be improved, expedited and implemented. The club should champion the shift of the current advanced economy paradigm of the IMF and World Bank to a more global paradigm incorporating emerging market influences.

Furthermore, the Beijing Club should advocate for the zoning of the IMF managing director's post to an official from an emerging economy as this could help reduce the inherent conflict of interest from having a director from a developed economy managing the affairs of an organization that is supposed to play a crucial role in the event of debt problems faced by advanced economies. The Beijing Club could also work toward encouraging the implementation of the recent proposal suggested by a panel of former policymakers, who advocated for the G20 to assume ultimate authority over the IMF.

In a multi-polar and post-Lehman Bros world where the economic tectonic plates are shifting in favor of the emerging economies and with the increased likelihood of a developed-economy sovereign debt crisis, the formation of a Beijing Club is a necessity.

The author is the chief economist & macro strategist for Diadem Capital Partners Ltd, London.

E-paper

Sindberg leaves lasting legacy

China commemorates Danish hero's courage during Nanjing Massacres.

Preview of the coming issue

Crystal Clear

No more tears

Specials

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Sentimental journey

Prince William and Kate Middleton returned to the place where they met and fell in love.

Rent your own island

Zhejiang Province charts plans to lease coastal islands for private investments