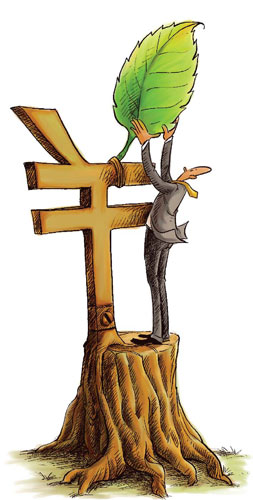

New five-year plan a shift to quality

Updated: 2011-03-11 10:25

By Ren Xianfang (China Daily European Weeklky)

China has released a draft of the 12th Five-Year Plan (2011-2015) at the annual sessions of the National People's Congress and the Chinese People's Consultative Conference National Committee.

|

|

On the external front, the government then was mostly worried about the economic and technological predominance of advanced economies, global competition for resources, market, technology and talents as well as trade protectionism.

Now the most prominent global risk is slower global growth, a shift in global demand structure, climate change, energy/resource security, in addition to those in the previous five-year plan with the exception of advanced economies' dominance in economic and technological arenas - obviously an intentional drop due to recent controversies on indigenous innovation.

On the domestic front, the government five years ago was most worried about unbalanced regional development, irrational economic structure, the lack of indigenous innovation, resource and environmental constraints, rural underdevelopment, employment and income distribution.

Now, topping the list of challenges are resource and environmental constraints, the unbalanced relationship between investment and consumption, the widening income gap, lack of scientific and technological innovation, irrational industrial structure, weak agriculture, unbalanced regional development and employment, among others.

It is interesting to note the drop from the plan of the controversial indigenous innovation, apparently in response to foreign investors' uproar on the issue over the past year.

With a new perception about risks, the government's priorities for the next five years have shifted. Growth makes way for development, with the government saying the main theme in the next five-year plan should be "scientific development" and a main thread should be the "transformation of economic development mode" - which has replaced "transformation of economic growth mode", a concept which ran through China's previous three five-year plans.

The shift is best illustrated by the new set of five-year development goals outlined, which has made no mention of a specific per capita GDP goal, widely taken as a sign the leadership is ready to accept a slower GDP growth rate going forward and instead will focus more on welfare improvement and on socioeconomic sustainability.

This focus on development, rather than growth, has multiple implications:

It means that GDP growth is likely to become a secondary goal, and that the leadership may be ready to accept a slower growth rate going forward.

It means the government will instead focus more on welfare enhancement, manifested in greater fiscal spending on social safety net and public services, as well as greater push for faster income growth.

The shift to development also implies greater focus on environmental and resource sustainability, as well as a shift to a growth model powered more by innovation and technological progress than by inputs of labor, resources and capital.

What could help achieve this transition is an overhaul of development goals for different regions in the next five years, and thus of a realignment of incentive structures for local governments based more on development priorities than on growth. The initiative was explored in the previous five-year plan period, and will be formally implemented in the new five-year plan period.

The basic idea is to classify China's territory into four "functional areas" based on the carrying capacity of local resources and the environment, as well as the intensity of existing economic activities and future development potential.

Based on this, the intensity of future economic activities will be regulated by the central government through various fiscal, investment, industrial, population and land policies, as well as through the adoption of different performance evaluation criteria for local governments.

Boosting domestic demand sits at the top of the agenda, and the leadership has made this point by placing consumption ahead of investment and exports in its proposal for the five-year plan. The leaders have called for the construction of a "long-term mechanism for expanding consumption", for which income growth, urbanization and rural development are all key underpinnings.

They have also mentioned "adjusting and optimizing investment structure", which should imply more investment in encouraged sectors and areas, such as agriculture, emerging strategic industries, underdeveloped regions, etc.

For foreign trade, the leadership is apparently looking more at the structure and added value, rather than the gross value of exports.

Imports will also be emphasized, as the government states that China's opening-up drive will switch from one oriented mainly toward exports to one oriented to both imports and exports.

Changing the structure of foreign trade will be a focus, with China probably aiming to lift its global ranking in service trade size to the top three.

To rebalance the relationship between the economy's three components - consumption, investment and exports - the government has realized that it needs to unlock the potential of domestic demand, particularly potential of China's vast underdeveloped regions and the vast rural population.

More importantly, the government is also fully aware of the need to conduct a systematic overhaul of the social, economic, financial, and fiscal mechanisms underpinning the present growth model as China's unbalanced economic structure has reflected myriad distortions in the country's socioeconomic system.

One main component of China's economic transformation is a new industrialization drive.

In the new five-year plan, the government has formally enshrined the idea of pursuing a "new industrialization path with Chinese characteristics", emphasizing the building of a new modern industrial structure that utilizes more advanced technology, which is cleaner and safer, and has higher added value and creates more jobs.

The focus will be on upgrading the manufacturing industry, developing emerging and strategic industries, bolstering the services sector, strengthening energy/transport infrastructure and developing the oceanic economy.

Both the new strategic sectors and the oceanic economy have been mentioned in a five-year plan for the first time.

Traditional sectors

Transformation of the traditional industries and moving up the value chain sits at the top of the agenda of China's new industrialization drive. As noted by Premier Wen Jiabao, China's manufacturing industry is still quite backward even though more than half the 30 manufacturing sub-sectors are the largest in the world.

The government is to take different approaches toward different sectors. The focus for the consumer goods industry - such as textiles and light industries - is upgrading. The focus for resource material industry, such as metals and petrochemicals, is readjustment - that is, consolidation, restructuring and elimination of outmoded capacity.

For advanced equipment industry, these industries will continue to receive policy support for expansion.

Emerging sectors

Another main thrust will be the development of new strategic sectors, a main strategy for China to seize the commanding heights of new technologies.

In a statement issued at the end of October, China's State Council announced the country will raise seven emerging and strategic industries' share in national GDP to 8 percent by 2015, from the less than 2 percent at present. The share of such industries will be further boosted to 15 percent by 2020.

The seven industries are energy conservation/environmental protection, new-generation information technology, biotechnology, high-end equipment manufacturing, new energy, new materials and new-energy-fueled vehicles.

The first four industries are also to become the pillar industries of the country by 2020, while the other three emerging strategic industries will be defined as leading industries.

Service sector

Services will remain a development priority, as in the previous five-year plan, for its key role in moving China from a resource/energy-intensive and job-light growth model to one that depends less on resource inputs and yet may create more jobs.

In the new plan, the development of the service sector will be closely incorporated with China's broad strategy of industrial structure upgrade, boosting domestic consumption, expanding employment and bolstering China's service trade.

In particular, the government is looking at the development of producer service industries such as industrial design, modern logistics and information services that can facilitate industrial upgrade. It is also looking at tourism to boost consumption.

Additionally, the government will also promote the formation of service-oriented economic structures in mega-cities, which should include Shanghai, Beijing and other developed cities in coastal China.

At present, only Beijing has a services-dominated economic structure, with services accounting for over 70 percent of the city's GDP.

The specific goal for service sector development is unknown yet. Nevertheless, the 21st Century Business Herald has reported that the Chinese central leadership may establish a target of boosting the share of services sector in total GDP from about 43 percent to more than 50 percent by 2015, meaning the 50 percent threshold is to be hit five years ahead of what had been planned in 2007 - when China unveiled a key guideline for service sector development.

Supposing that China attains the 50 percent target, it will imply that the country will raise such a ratio by about 7 percentage points in five years - a much larger gain compared with the around 3-percentage-point increase for the 11th Five-Year Plan (2006-2010).

For that to be achieved, the government has pledged to formulate fair, transparent and regulated market entry standards that are key for wider private sector participation, and to adjust tax policies and lower land/utilities prices for service companies; the services sector is charged higher fees for land and utilities than mining and manufacturing firms, reflecting a long-standing policy prioritizing manufacturing development.

The author is a senior China analyst with IHS Global Insight.

E-paper

Sindberg leaves lasting legacy

China commemorates Danish hero's courage during Nanjing Massacres.

Preview of the coming issue

Crystal Clear

No more tears

Specials

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Sentimental journey

Prince William and Kate Middleton returned to the place where they met and fell in love.

Rent your own island

Zhejiang Province charts plans to lease coastal islands for private investments