Style

Off the Catwalk, a battle for Hermes

Updated: 2011-03-22 11:36

By Liz Alderman (China Daily/Agencies)

|

|

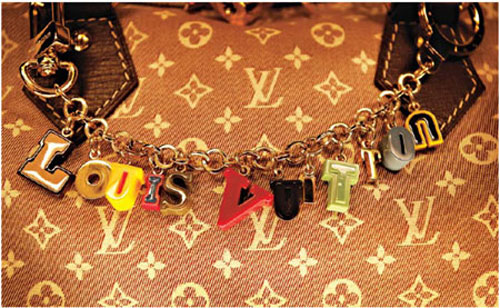

Bernard Arnault has bought many luxury brands, including Louis Vuitton, and has set his sights on Hermes. Photographs by Ed Alcock for The New York Times |

Bernard Arnault, France's richest man and the force behind the vast LVMH Moet Hennessy Louis Vuitton empire, is eager to put the John Galliano affair behind him. Mr. Arnault recently fired his star designer after Mr. Galliano's anti-Semitic rant in a Paris bar.

As jarring as the Galliano incident has been for Dior, one of Mr. Arnault's companies, he has not lost sight of his latest acquisition target: Hermes International. Since October, Mr. Arnault has been pursuing Hermes, the 174-year-old family fief whose silk scarves and Kelly and Birkin handbags are highly coveted.

Mr. Arnault says he will not interfere with Hermes's management or traditions. "We are a totally peaceful investor," he said. "But as a leader in the best quality products in the world, we believe we can bring a certain savoir-faire to improve the functioning of their business."

To people at Hermes, LVMH represents everything Hermes is not. Mr. Arnault has spent the past three decades acquiring one luxury brand after another and then hiring designers like Mr. Galliano and Marc Jacobs (for Louis Vuitton) to invigorate old labels. That Mr. Galliano was given the keys to Dior only to self-destruct seemed to confirm the worst fears of Hermes executives.

"There is a part of our world that is playing on abundance, on glitz and glamour," said Patrick Thomas, the Hermes chief executive. "And there is another part that is concentrated on refinement, and basically making beautiful objects.

"We don't want to be a part of this financial world which is ruining companies and dealing with people like they are goods or raw materials," he added. "It's not a financial fight, because we would lose that. It's a cultural fight."

|

Mr. Arnault says Hermes has nothing to fear. "I would never diminish the quality of Hermes," he says. "Hermes can be an even rarer and greater quality business, if they ever wanted to work with us."

For instance, he would like to see Hermes leave duty-free stores at airports, eliminate all discounts and bring in younger employees. He did away with discounts at Louis Vuitton in an effort to elevate its monogrammed leather handbags and other accessories. He imbued those products with an elitist quality and made them must-have items.

Axel Dumas, 40, is a passionate member of the sixth generation at Hermes. He says that, if anything, Mr. Arnault's uninvited presence has brought even the youngest generations into solidarity with the old.

"In a way, this brought all of us closer together," said Mr. Dumas, who will soon take over as chief operating officer. "There's always arguments within a family, but the fact is that after the announcement, everybody joined ranks without even discussing it. They want to protect Hermes."

At LVMH, sales rose 19 percent last year and, for the first time, exceeded 20 billion euros. Profits soared 73 percent, to 3 billion euros. Revenue from fashion and leather goods, like Louis Vuitton purses, was up 20 percent.

Last year, Hermes turned a profit of 421.7 million euros on sales of 2.4 billion euros. A single Birkin bag, named after the actress Jane Birkin, costs 3,500 to more than 40,000 euros.

In October, LVMH announced that it had acquired 17 percent of Hermes, with the aim of buying more.

Mr. Arnault had quietly amassed his stake in Hermes not by buying its stock but by wielding one of the most potent weapons in finance: derivatives. He used instruments called equity swaps that essentially gave him the option to buy a big chunk of Hermes over a certain time.

The family is now seeking to create a special company to hold more than 50 percent of its shares in the business, in an effort to prevent another incursion.

LVMH will wait for Hermes - "one century, or even two centuries," says Pierre Gode, Mr. Arnault's top adviser. "If the family ever wants to leave, we believe we're capable of soothing away all these fears that we're mass market."

Mr. Dumas says his family will never sell. All the family can do, he says, is stand firm in what its members see as a battle for the very soul of Hermes. "If it doesn't destroy us," Mr. Dumas says, "it will make us stronger." (The New York Times)

E-paper

Rise and shine

The Chinese solar energy industry is heating up following recent setbacks in the nuclear sector

Preview of the coming issue

Bombs aim for regime change

CSI, with a twist

Specials

Peony express

Growers of china's unofficial national flower are reaching out to europe for help

Tea-ing up

More turning to Chinese tea for investment opportunities like vintage wine

A cut above

The ancient city of Luoyang is home to a treasure trove of cultural wonders.