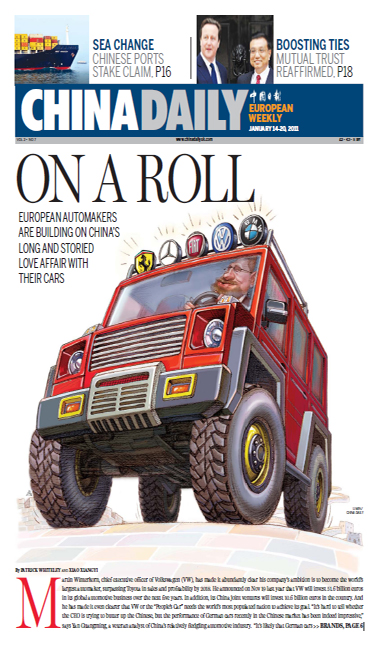

On a roll

Updated: 2011-01-14 10:37

By Patrick Whiteley and Xiao Xiangyi (China Daily European Weekly)

"Of course, the price advantage of Chinese brands sways the decision (in favor of Chinese brands) of price sensitive buyers."

The year 2010 was not only the Year of the Tiger in China, it was also the year of the car. More than 18 million automobiles were sold, making the nation the world's largest auto market for a second year running.

The market increased by more than 30 percent from 2009, but analysts have predicted that it may slow between 10 and 15 percent, after Beijing recently launched a strict policy to curb car consumption, which were prompted by environmental and traffic congestion concerns.

The Ministry of Finance also announced in December 2010 that China will stop the two-year consumption-tax cuts for smaller cars, which has helped drive sales.

From 2011, a sales tax of 10 percent will be imposed on cars with engines of 1.6-liters or smaller, from 5 percent in 2009 and 7.5 percent in 2010.

The Chinese government's "cash for clunkers" program, in which 6.41 billion yuan of subsidies were issued in 2010, was also stopped this year.

"Don't be optimistic for China's automobile market in 2011," says Jia Xinguang, an independent auto analyst based in Beijing.

"At the expiry of the stimulus measures, especially the tax policy, there will be a restructuring in the auto market in terms of engine capacity."

Jia says that the automakers, especially domestic carmakers with models with engine capacities of 1.6 liters or less, will face a challenge in 2011.

"They have to make great efforts to improve quality and strengthen the brand of their cars," Jia says.

Considering there are more than 90 car brands on the Chinese market, the demand for new cars has kept both the joint-venture and local manufacturers busy and pushed prices down. It also has been a golden period for Chinese carmakers in terms of sales.

More than 6.27 million Chinese-branded passenger vehicles were sold last year, taking up the biggest share in Chinese market.

Budget cars start from as low as 20,000 yuan (2,335 euros) with models and marques unheard of in Europe, such as the BYD F0, the Geely Panda and the Chery QQ.

These subcompact cars have been selling 10,000 units each month and have been boosting their company's -and China's - sales figures. But despite the high sales volume, profit margins are small on such budget vehicles, so the Chinese companies are taking on foreign brands with higher priced models in the 100,000 yuan to 120,000 yuan range.

Making up the foreign contenders are six countries - Japan, German, the US, South Korea, France and Italy - and all operate as joint ventures with a Chinese partner. Many have two partners.

Although they are not the highest selling, they are the most profitable, and for many aspiring Chinese drivers, they are the most desirable.

Paper's Digest

Posh parade

Luxury carmakers are gearing up for rich pickings in China.

Preview of the coming issue

Driving ambition

Sea Change

Specials

Hu visits the US

President Hu Jintao is set for a state visit to the United States from Jan 18 to 21.

Royal ring

British royal engagement ring spurs demand for chinese replicas.

Stars on horizon

The 'longlist' for Literary Prize raises strong hopes about future of East Asian writers of English books.