Buyers burned by price-cooling measures

Updated: 2016-04-29 08:10

By Wang Ying(China Daily)

|

|||||||||

Although new policies to curb Shanghai's overheated housing market are already having an impact, many potential purchasers say the amended regulations have pushed homes out of their price range. Wang Ying reports from Shanghai.

Wang Huiyao and her husband were so eager to buy a home in Shanghai that they cashed in all their investments and paid 60,000 yuan ($9,240) to be given priority in the line for a new development that would be launched on March 26.

After all their meticulous planning and preparation, it appeared that they were finally going to own a home in the city after five years of searching.

However, on March 24, rumors began circulating that the regulations related to house purchases would be amended, making property much more difficult to buy. As a result, property transaction centers in the city were deluged with thousands of prospective buyers looking to seal deals. It spelled the end of Wang's dreams of buying a home.

She only learned of the frenzy on the morning of March 25, by which time the regulations had changed, and, although Wang didn't know it at the time, the property she wanted was now out of her price range.

"We were not sure what the commotion was all about. Did it mean that the property market was overheated? Were people just overreacting? It was hard to tell, so we decided to go to work as usual and buy our apartment the next day as planned," she said.

The new regulations stipulated that people without Shanghai hukou - household registration permits - would have to pay tax for at least five consecutive years before being allowed to buy a property in the city. The previous policy only required two years of tax payments, so Wang and her husband, who moved to Shanghai from Shenzhen, Guangdong province, in 2012, were now ineligible to buy a new home.

Wang has received calls from several agents trying to persuade her to buy an apartment in Kunshan or Suzhou, cities in neighboring Jiangsu province, and suggesting the couple could commute between home and work by metro.

"But the idea of living in another city is not that attractive to us, and property prices in those places have surged a lot recently as well," Wang said.

Lin Hong was luckier than Wang. After braving the crowds at the transaction centers on March 24, she managed to secure the purchase of her family's second home and avoid the imminent down payment hike.

It helped that the transaction deadline for the day was extended from 9 pm to midnight because so many people were using the applications website that the system crashed.

According to the new policies, local families looking to buy a second home must provide a down payment of at least 50 percent of the total price. The figure rises to 70 percent if the house is more than 140 square meters, or costs more than 4.5 million yuan ($695,000) and is located within the inner ring road.

The same rules apply if the property costs more than 2.3 million yuan and is located beyond the outer ring. Before the policy was changed, the down payment on second homes was 40 percent.

Lin's second home is a three-bedroom house in the city's Qingpu district. It lies beyond the outer ring, so after the rule change the down payment would have been 70 percent, far beyond the family's means.

"It is hardly imaginable that white-collar people like us could make a down payment of 70 percent, as required by the new rules," she said.

The 31-year-old said her family started looking for a second home a year ago, and they were about to buy an apartment in the Gubei area in Changning district when the owner raised the asking price by 500,000 yuan.

"We thought that the prices for second-hand homes were insane. We later switched to looking at new houses in suburban areas instead," she said.

According to Gu Jinshan, director of the Shanghai Housing and Urban-Rural Development Management Committee, the surge in Shanghai's property prices started in the second half of last year, and was still growing by the beginning of January.

According to Gu, several factors drove the rise, such as relaxed policies on mortgages and new tax policies designed to benefit home buyers, a limited supply of homes, the return of investing and speculative demand, and the irregular practices employed by some property agencies.

Jiang Yizhen, an outlet manager with property consultancy Centaline in Shanghai, said that one of the most extreme examples of price hikes occurred in February before the Chinese New Year when a 102-sq-m unit in Yangpu district was priced at an unusually high 4.3 million yuan.

He said the owner raised the asking price every time a potential buyer agreed to the new price, and later learned that another property agency had managed to sell the apartment for 5.85 million yuan. However, in the wake of the new policies, some owners have already started lowering their asking prices, he added.

Contact the writer at wang_ying@chinadaily.com.cn

|

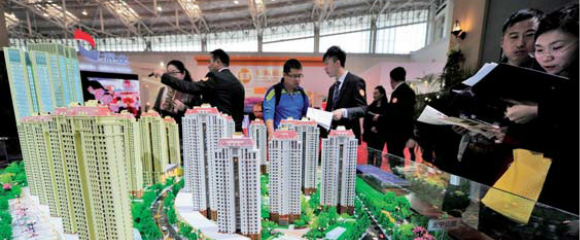

On March 24, the day before the new property rules were introduced, thousands of hopeful home buyers descended on real estate companies such as Lianjia looking to secure a deal before the midnight deadline. Gao Erqiang / China Daily |

(China Daily 04/29/2016 page6)

Today's Top News

Russia launches rocket from Vostochny Cosmodrome

Record number of Chinese exhibitors at Spanish expo

Beijing least affordable city in the world to rent

US accused of 'hyping up' military flights

Banks offer passport to integration

Obama casts doubt on post-EU deal

Chinese runners flood London for marathon

Chinese philanthropists explore British way of 'giving'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|