Central bank expects to maintain a 'prudent' monetary policy

Updated: 2016-04-28 08:32

By Zheng Yangpeng(China Daily)

|

|||||||||

As Zhou Xiaochuan, People's Bank of China governor, spoke at the G20 gathering in Washington, he seemed more relieved than 50 days ago, when the last such gathering was held in Shanghai. Cascading fears about a hard economic landing for China had receded, replaced with improved growth momentum. Pressure on deflation and capital outflow had eased; commodity prices, which had plunged in the previous six months, staged a rebound.

Zhou flagged these achievements at the meeting, especially the strong bounce in March. As a Xinhua report put it: "Positive signs are converging, boosting sentiment that the slowdown in the Chinese economy may be bottoming out."

The governor reiterated that the central bank will maintain a "prudent" monetary policy, but be "flexible" and "appropriate" in its implementation. This is a nuanced shift from 50 days ago, when he pledged a "prudent" monetary policy with "a bias toward easing". That statement was widely reported and interpreted as the central bank's readiness to scale up liquidity injection if required.

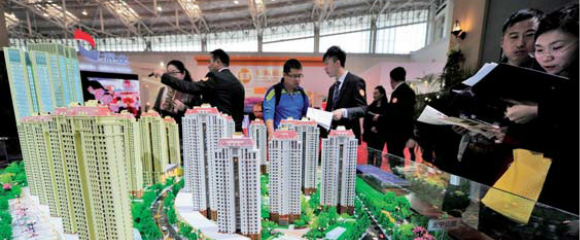

Actual credit growth in the first quarter dovetailed with what Zhou had implied. Quarterly new aggregate financing reached a new historical high of 6.59 trillion yuan ($1.01 trillion), 1.93 trillion yuan more than the same period last year. New loans extended by banks jumped to 4.61 trillion yuan, nearly 1 trillion yuan more than the same period last year. Bloomberg Intelligence Economics' China Monetary Conditions Index rose in March, hitting its highest level since September 2011, thanks to PBOC's strong pro-growth real interest rate stance, outstanding loans and real effective exchange rate.

The upward track has lessened the need for further monetary easing, which is why Zhou didn't mention the "bias toward easing" this time, analysts said. In fact, the International Monetary Fund and several global banks have raised their outlook for China's GDP growth rate this year, after the first quarter. UBS and J.P. Morgan said they see no hope that the benchmark interest rate will be cut this year.

While optimistic about China's short-term growth outlook, global banks see medium to long-term risk rising, as the first-quarter's rebound remained credit-fuelled. Nomura noticed that the incremental credit-output ratio -or how much new credit is needed to generate one unit of real GDP growth - jumped to a record-high of five in the first quarter because of the diminishing effect of credit.

"The adoption of countercyclical macro policy is helpful to stabilize growth, but it comes at the cost of other policy objectives. In particular, the acceleration in credit growth in recent quarters suggested that the debt in the economy, especially corporate debt, will continue to move up," said Zhu Haibin, J.P. Morgan China chief economist.

"This could lead to further deterioration of financial risks, especially without a credible resolution scheme, for example a bankruptcy scheme, to address the corporate debt problem."

Even Zhou acknowledged there is a serious problem with China's debt, and has raised the issue several times in recent months. He warned corporate lending as a ratio to GDP had become too high and the country must develop more robust capital markets to mitigate that risk.

China's corporate debt is the highest among major economies, amounting to 166.3 percent of GDP by the end of the third quarter, according to the Bank for International Settlement. However, Zhou noted that compared with countries without high saving rates, the ratio is not that high. China boasts the highest saving ratio at nearly 50 percent.

zhengyangpeng@chinadaily.com.cn

(China Daily 04/28/2016 page7)

Today's Top News

Beijing least affordable city in the world to rent

US accused of 'hyping up' military flights

Banks offer passport to integration

Obama casts doubt on post-EU deal

Chinese runners flood London for marathon

Chinese philanthropists explore British way of 'giving'

Back on the up

China leads way on US adoptions

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|