Honesty offers promise of prosperity

Updated: 2015-12-18 08:29

By Tan Yingzi in Xining(China Daily)

|

|||||||||||

|

Farmer Chong Shangwei explains details of his rabbit farm in Houjuhua village, Hainan Tibetan autonomous prefecture, Qinghai province. Tan Yingzi / China Daily |

Personal integrity helps poor people qualify for loans out of reach in past

Except for a small plot of land and one shabby shed, farmer Chong Yushan owns no valuable property, nor does he have much cash flow.

In the past, banks would never consider a poor family like Chong's to be a trustworthy borrower.

Yet without collateral or startup money, how can the poor gain wealth? Increasingly, the answer is personal credit based on personal integrity.

Banks need to set up a special credit evaluation system for poor rural families and give them poverty assistance loans according to their rating, as long as they are able to work and have a feasible business plan, said Lin Jianhua, director of the People's Bank of China's Xining Central Sub-branch in Qinghai province.

The Chinese government has pledged to enact more support policies, including financial tools, to lift the country's 70 million poorest people above the poverty line by 2020.

President Xi Jinping announced the plan in October at the Global Poverty Reduction and Development Forum in Beijing.

In China, as in so many places around the world, a lack of opportunities, along with disabilities, diseases and natural disasters, can push a family into poverty or make it hard to climb out.

Led by the central bank's Xining branch, Qinghai is one of the first provinces to develop a system to provide personal credit to the poor as part of its poverty alleviation financial services.

Situated in the northeast part of the Qinghai-Tibet Plateau, where the average altitude is more than 3,000 meters above sea level, Qinghai is home to the Han, Tibetan, Hui, Mongolian, Tu and Salar peoples.

The province's high altitude, cold climate, oxygen deficiency and vulnerable natural ecosystem have made it a front line in China's bid to eradicate poverty.

Among its 5.7 million residents, nearly 10 percent live below the official national poverty line of 2,300 yuan ($357) in annual income.

In June, the central bank's Xining branch rolled out a plan to provide loans to poverty-stricken families. It chose the Qinghai Rural Credit and Postal Savings Bank, which has a wide rural network, to work individually with potential borrowers.

Chong, 48, lives in Houjuhua village, Longyang town, Gonghe county in Hainan Tibetan autonomous prefecture. Fewer than 10,000 people live in the town.

He and his wife have two sons, one in high school and another in college. The family earned 2,300 yuan per person last year, right at the poverty line. In October, staff from the local branch of Qinghai Rural Credit visited him and set up his account.

The credit evaluation reviewed four main points: personal integrity, number of laborers in the family, labor skills and net income in the previous year.

Integrity is highly valued and accounts for 36 of 100 possible points, so the bank staff meets with village officials and seniors to decide the score. They ask many questions: Is this man lazy? Does he love his country and obey the rules? Does he participate in charity activities? Does he get along with his neighbors? Does he gamble or do drugs?

Chong, with a junior high school diploma, scored high in personal integrity, but low in labor skills and the number of family members in the labor force. His application received 73 points and a 30,000 yuan interest-free loan limit.

With his Poor Family Credit Certificate, Chong borrowed 10,000 yuan from Qinghai Rural Credit in less than a week and started a rabbit farm.

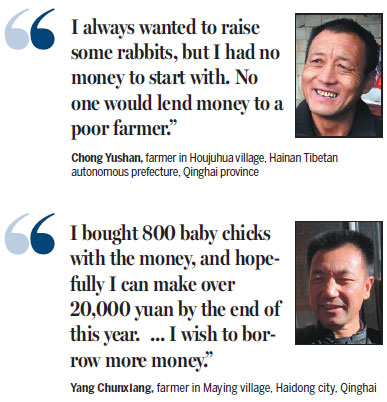

"I always wanted to raise some rabbits, but I had no money to start with," Chong said. "No one would lend money to a poor farmer."

He joined the Rex Rabbit Co-op in the village and received 230 rabbit kits. After they mature, the co-op will buy them back at the market price. Chong expects to earn about 10,000 yuan each year from the rabbit farm.

"Now I can give a bigger allowance to my son in college," he said.

In Chong's village, 20 poor families have received credit certificates, and 17 have obtained loans of about 10,000 yuan each.

"Some of our poor families really want to do some business and get rich," said Tashi, Party chief of Longyang town. "But in the past, the banks were afraid of bad loans, and the government could not provide any financial guarantees. This was a big headache for us in our poverty alleviation work."

Yang Chunxiang, 49, is another beneficiary of the credit system. Stricken with polio, he cannot leave his village to work in the cities or do heavy labor in the countryside, and he is trying to support two sons in college. The bank gave him a 50,000-yuan loan to help him build a chicken farm.

Deep in the mountains, Yang's village of Maying in Haidong city is famous for its free range chickens that eat wild green onions.

"I bought 800 baby chicks with the money, and hopefully I can make more than 20,000 yuan by the end of this year," Yang said. "Next year, I wish to borrow more money to enlarge my farm."

At the end of November, Qinghai province had issued 6,517 credit certificates to poor families. Their bank loan balances totaled 240 million yuan. No bad loans have occurred so far, according to the central bank's Xining branch.

"We will complete the rural personal credit evaluation system by June next year and help lift our clients out of poverty by 2018," Lin said.

Today's Top News

Xi calls for shared future in cyberspace

China successfully launches its first dark matter satellite

China becomes shareholder in European bank

Jeb Bush calls Trump a 'chaos candidate'

French report stresses China's growth offers new opportunities

Reasonable economomic growth rate targeted

French far-right fails to win any regions

Obama says anti-IS fight continues to be difficult

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|