The bitterest pill for hepatitis C patients

Updated: 2015-12-17 07:50

By Shan Juan(China Daily)

|

|||||||||||

|

|

A researcher checks the vaccination against hepatitis B. [Photo/CFP] |

Treatment costs falling

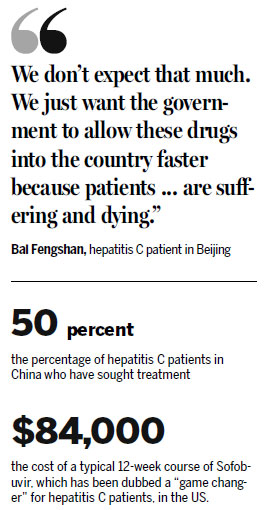

Initially, the treatment didn't come cheap; a 12-week course of Sofobuvir cost hundreds of thousands of yuan,

but the price fell after Gilead Sciences signed a voluntary licensing agreement with seven Indian drug manufacturers in September last year.

Under the agreement, the Indian companies were allowed to produce and sell generic versions of the drug in 91 countries. However, countries with high rates of hepatitis C, such as China, Brazil, Thailand and Mexico, are excluded.

The agreement resulted in the cost of the treatment in India falling to $900, and made the country a hot destination for Chinese patients seeking affordable treatment.

Internationally, many pharmaceutical companies employ a tiered pricing structure, mainly based on income levels standardized by the World Bank. China and several other countries with high rates of hepatitis C are classified as "middle income", meaning that patients are unable to buy drugs at lower prices.

The ruling resulted in some countries resorting to compulsory licensing, making cheaper copies of drugs to ensure treatment for domestic patients.

Zheng Hong, head of pharmaceutical affairs at the National Health and Family Planning Commission, said China has never issued compulsory licensing for any drug. "China lacks related policies, but the patent authorities have been researching the issue," he said.

At present, 16 government agencies - including the National Health and Family Planning Commission, the China Food and Drug Administration, the National Development and Reform Commission and the State Intellectual Property Office - are trialing a centralized drug-purchasing mechanism.

"We've initiated price negotiations with manufacturers of patented drugs in a bid to lower the cost for patients in China," Zheng said.

The negotiations are centered on a treatment for hepatitis B called TDF, which is also manufactured by Gilead Sciences.

Patients excluded from China's health insurance system have to pay 17,000 yuan ($2,630) every year for the drug, which requires long term use.

However, under the country's independent HIV/AIDS centralized drug-purchasing system, a 12-month course of the same drug, which is also used as a treatment for AIDS, costs 1,450 yuan per patient. The Chinese government has provided free treatment for people with HIV/AIDS since 2003.

Wei, of Peking University People's Hospital, urged the government to trial a centralized purchasing system for hepatitis C drugs to lower the price.

There is no vaccine for hepatitis C, so curing patients helps to curb the spread of the virus, which has similar transmission routes to HIV, according to Wei. "It benefits the patients, and has great public health significance," he said.

Most hepatitis C patients in China were infected in the late 80s or early 90s, prior to routine screening at blood centers, and so "the treatment is urgently needed to prevent more cases and save lives", Wei said. Given that cirrhosis medication costs 40,000 yuan a year and treatment for liver cancer is even more expensive, the introduction of TDF "would help reduce the country's medical bills", he added.

Last year, about 350,000 people were diagnosed with liver cancer in China, according to country's official cancer registry. More than 80 percent of cases were caused by chronic hepatitis of various types, and they result in more than 380,000 cancer-related deaths in China every year.

Today's Top News

Xi calls for shared future in cyberspace

China successfully launches its first dark matter satellite

China becomes shareholder in European bank

Jeb Bush calls Trump a 'chaos candidate'

French report stresses China's growth offers new opportunities

Reasonable economomic growth rate targeted

French far-right fails to win any regions

Obama says anti-IS fight continues to be difficult

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|