Yuan move is likely to deliver positive results in long term

Updated: 2015-08-18 07:34

By Zhang Chunyan(China Daily)

|

|||||||||||

|

|

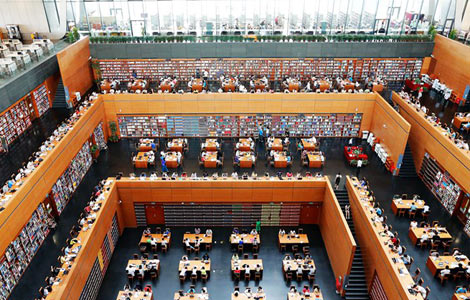

China's move to weaken the yuan last week could head off further similar "adjustments", and the yuan is likely to move in both directions as the economy stabilizes, Ma Jun, chief economist at the central bank said on Sunday. [Photo / IC] |

Depreciation of China's currency offers opportunities for economies in Europe

Last week's depreciation of the yuan stoked fears that European exports to China could be hit. As the euro and the pound strengthened, concerns started to grow that companies selling goods to the second-biggest economy in the world would see their trading margins shrink.

But that scenario is unlikely to be played out in the long term as the yuan becomes a major global currency. The People's Bank of China, or central bank, made the decision to reform the exchange rate mechanism to better reflect the yuan's strength against the US dollar.

The International Monetary Fund called the move to allow a greater role for market forces in China's currency "a welcome step". And this will certainly raise the prospects for the yuan to join the IMF Special Drawing Rights currency basket, which consists of the US dollar, the euro, the pound and the yen, sooner rather than later.

In recent years, London, Frankfurt and Paris, along with Luxembourg, have vied to become the main trading center for offshore yuan payments in Europe.

Roughly one in five companies on the continent invoice in yuan. Around 80 percent of non-yuan users want to switch to the currency for invoicing, according to Frankfurt Main Finance, a group supporting Germany's financial center. At a global level, yuan payments increased in value by 29 percent in March 2014 compared to a month earlier.

China's central bank has promised more foreign exchange reform along the lines of "market-orientation", and this in turn will produce greater opportunities for Europe's main financial centers.

Naturally, the weaker yuan will boost China's struggling exporters as their products become cheaper for overseas buyers. This will mean foreign goods will become more expensive for Chinese consumers.

But high quality European products are unlikely to suffer. China's consumers are becoming more affluent and they will continue to buy brands they respect and trust. Analysts have highlighted the challenges facing luxury labels, which have counted on Chinese shoppers to boost sales growth and increase profit margins.

In the past four years, luxury brand consumption has surged at rates of between 16 percent and 20 percent annually. Despite the depreciation in the yuan, demand for these products among the country's wealthy middle class will stay strong. European brands such as Louis Vuitton, Burberry and automaker BMW will continue to remain popular.

The rise of e-commerce has helped fuel demand from Chinese consumers who have refused to compromise on cheaper alternatives. Slightly higher prices will not dent their enthusiasm for these major brands.

Apart from luxury labels, another growing sector for European companies is the food and beverage industry. Exports of fruit, cheeses and wines from the continent are growing as well as chocolate products.

According to the Chinese Embassy in London, China has become the United Kingdom's second most important food market outside the European Union. Last year, exports of pork and salmon almost doubled.

Another key area is Chinese investment in European countries. That has increased during the past five years and it looks likely to continue as Chinese companies expand their global presence.

In the United Kingdom, Chinese investment has been encouraged in infrastructure, transport and energy sectors. High-speed rail networks, offshore wind power and solar projects have been three key areas that have attracted attention.

Overall, as China shifts toward domestic consumption and greater innovation in its manufacturing industry, economic growth will become more stable. At the same time, the Chinese market will continue to open up, while domestic companies will forge ahead on the international stage.

In the meantime, the depreciation of the yuan will be an unexpected bonus for the tourism industry. European visitors will benefit from the cheaper currency and stimulate growth in the travel sector. Between January and May this year, the number of inbound tourists to China increased by 4.8 percent to 54.58 million compared with the same period in 2014, according to the China Tourism Academy.

While visitors from Asian countries made up 64 percent of that total, the share of European tourists dropped as the yuan strengthened and economic recovery in Europe slowed. Maybe now, increased spending power will reverse that trend.

Contact the writer at zhangchunyan@chinadaily.com.cn

Related Stories

Weakened yuan expected to help nation's car exports 2015-08-17 11:28

Get ready for yuan in IMF basket 2015-08-17 11:22

PBOC economist expects more stable yuan on new forex policy 2015-08-17 10:43

China yuan to move both ways, more 'adjustments' unlikely 2015-08-17 07:43

China advances exchange rate reform, a credit positive 2015-08-15 17:22

Today's Top News

Man in yellow shirt is Bangkok bomber: Police

Insured losses from Tianjin blasts could reach $1.5 billion: Fitch

Beijing dismisses reports of Abe's China visit in September

Europe struggles to respond as migrants numbers rise threefold

Chinese city salutes a very British hero with a statue

Six Chinese nationals confirmed dead in Bangkok blast

Rain in Tianjin poses no health risk, says official

Two HK women among four Chinese killed in Bangkok blast

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|