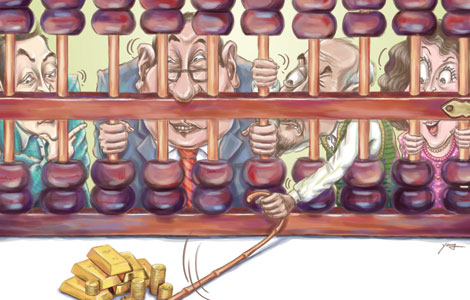

Hungry investors on the hunt for their pot of gold

Updated: 2013-05-20 07:18

By Jiang Xueqing in Beijing (China Daily)

|

|||||||||||

Lack of options

Earlier this month, Zhang Yun, a 62-year-old retired government worker in Chengdu, Sichuan province, and her husband bought a five-year government bond yielding 5.5 percent per annum. The benchmark interest rate for a five-year fixed deposit is 4.75 percent.

The bank was scheduled to open at 8:30 am. When the couple arrived half an hour before opening time, a huge crowd had already gathered at the door. The minute the bank opened, the assembled throng rushed inside to grab a ticket and waited for their numbers to be called.

"I hadn't seen a scene like that for a long time. People were fighting each other to buy government bonds like crazy," she said.

According to Cheng Yuan, director of a housing fund project for Tsinghua Real Estate CEO Chamber of Commerce: "The real problem is that China does not offer a wide choice of long-term investment vehicles. Apart from works of art and gemstones, the only choice is real estate. That's why property prices keep rising, even though they are already too high."

Following a central government decision to rein in soaring property prices, city governments across China outlined detailed regulations in March to tighten control of the real estate market. Those measures included a 20 percent capital gains tax on property sales in cities where the price of residential property is believed to be rising too quickly.

The regulations are extremely stringent in some cities, such as Beijing, but relatively lax in places such as Guangzhou in Guangdong province and Hangzhou in Zhejiang province.

However, contrary to central government expectations, property prices have continued to climb, even after the cities unveiled the new regulations. The average price of new apartments in 100 Chinese cities hit 10,098 yuan per square meter in April, a rise of 1 percent from the previous month, according to a report from the China Index Academy.

"Considering that China will roll out a new urbanization plan, the real estate market is not as pessimistic as it appeared when the central government announced the new regulations. The prices of glass, steel and coking coal, sectors closely related to the housing and construction markets, are likely to rise after falling sharply in the wake of the regulations," said Zhou of Beijing CIFCO Futures.

She suggested that investors should pay close attention to futures and stocks related to construction materials.

In addition to a dearth of long-term investment options, a lack of financial expertise is a major obstacle for non-professional investors, said Cheng of Tsinghua Real Estate CEO Chamber of Commerce.

"Some derivatives are too complicated to explain to investors and have to be traded by the professionals, but real estate is easy to understand. The price is mainly decided by location and the property is right there for the homebuyers to see and ready for the owner to live in," he said.

He noted that government regulations on the interbank and securities market have prevented many profitable and well-run companies from launching financial products that offer with a good return on investment on the Chinese mainland.

SOHO China Ltd, a leading commercial property developer listed in Hong Kong, announced in November that it had issued $600 million worth of five-year senior notes with a yield of 5.75 percent in Singapore, plus $400 million 10-year senior notes yielding 7.125 percent.

"If the company wanted to issue senior notes in China, it would have to go through a complicated procedure for government examination and approval, which would take a long time and cost a lot of money," Cheng said. "I believe that many financial products could be made available to the public if the government relaxed its control of the financial markets."

Related:

Profit and loss

Chinese investors look overseas

Related Stories

Investors shake off speculation of new listings 2013-05-04 01:18

Survey: Investors seek overseas investments 2013-04-18 22:04

More domestic investors eyeing W China 2013-04-08 16:44

Demand for gold at record high in Q1 2013-05-17 03:06

Price freefall prompts gold rush 2013-04-19 19:21

Today's Top News

Bird flu hits poultry industry for $6b

ZTE banks on growth in Indian telecom market

Top restaurants feel effect of new rules

Premier's visit to fuel economic cooperation

Call for more holiday time

Handicraft masters look for apprentices on job fair

China urges release of fishermen

Yingxiu five years on

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|