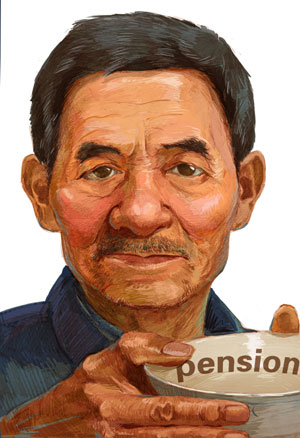

Pension: the age-old problem

Updated: 2012-06-25 07:30

By He Na and Chen Xin (China Daily)

|

|||||||||||

Workers fear they may be pensioned off in their prime, He Na and Chen Xin report in Beijing.

Time has been kind to He Yumei. The experienced nurse has such a youthful complexion that she and her daughter are often mistaken for sisters. Few people believe she is 52, just three years away from one of the mandatory retirement ages for women in China.

|

|

He, who works at a hospital in Jilin city in the northeastern province of Jilin, has boundless energy and even the trainees in her department comment on her high work rate.

"I really can't associate the word 'retirement' with my mother, and neither can she. She's a career-oriented person and would definitely be depressed if she stayed at home every day," said her daughter Wang Qiao, 22.

"I am in comparatively good health and full of experience and passion for my work. Why should I stay at home at such a young age? The average lifespan in China is over 70," He said.

More important, as a single mother, she's the family's main breadwinner.

"My daughter needs a lot of money to complete her further education. My pension would only be half my current monthly salary of 5,000 yuan ($785) and would hardly cover our living costs and mortgage. I heard some people say the retirement age may be raised. If that's true, I'll raise both hands," she said.

A proposal to extend the retirement age triggered heated discussion on the Internet after officials at the Ministry of Human Resources and Social Security suggested on June 5 that an extension is inevitable because of China's continuing social and economic development and increasing life expectancy.

"Since the 1970s, the retirement age has been set at 60 for men and 55 or 50 for women, depending on their job. That's much earlier than in other countries. The general retirement age in European countries is 65," said Xia Xueluan, a professor of sociology at Peking University in Beijing.

"With life expectancy increasing, there should be a corresponding change in the pension policy. However, because the extension will affect everybody, we need to avoid strict regulations and implement a voluntary and flexible policy, depending on people's health and willingness to work," he said.

"That would be good news for me. Otherwise, I would have to find another job after retiring to make ends meet," said He Yumei.

However, an extension is the last thing her brother-in-law wants. Wang Qizhong, 50, a driver at a small-scale private tire factory, earns 1,500 yuan in cash per month, but his employer makes no contribution to his insurance or pension payments. Every month, Wang has to pay 450 yuan into his pension account with the local social security bureau. "My wife and I don't have permanent jobs, so we have to pay the pension insurance ourselves," he said.

His wife, 49, who has been laid off, used to sell vegetables on the street, which is technically illegal although the authorities often turn a blind eye. However, the street is not a safe place for vendors and they play a perpetual game of hide and seek with the chengguan, urban management officers, who consider the sellers an eyesore.

"The postponement of the retirement age will make our lives even more miserable. Even when I work 30 days a month, my wage is still less than my sister's pension will be. I will be the first one to go against the policy and will vote for earlier retirement instead," added Wang.

"Even my neighbor, who's a teacher and is set to retire next year, doesn't want to leave work. If the retirement age is raised, people like my sister and neighbor will continue to enjoy medical services and various types of allowance. But people like me, those who don't have stable jobs, once we lose our jobs, we not only do not have an income but still have to hand over a lot of money every month. Do you think we'll applaud an extension?" he asked.

|

|

A migrant worker carries his bag as he leaves Bozhou Railway Station in Anhui province late last month. Liu Qinli / for China Daily |

Started in 1997, China's current pension system consists of public and individual accounts, both funded by social security taxes. Employers pay an amount equal to 20 percent of each worker's wages each month to fund the public account. Workers also pay 8 percent of their wages into their individual accounts. They must contribute for at least 15 years to become eligible for a pension and the amount they receive depends on the earnings that produced the sum in both accounts.

Today's Top News

President Xi confident in recovery from quake

H7N9 update: 104 cases, 21 deaths

Telecom workers restore links

Coal mine blast kills 18 in Jilin

Intl scholarship puts China on the map

More bird flu patients discharged

Gold loses sheen, but still a safe bet

US 'turns blind eye to human rights'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|