From Chinese media

China concepts stocks will survive: Analyst

Updated: 2011-07-12 17:18

By Song Jingli (chinadaily.com.cn)

Stocks of Chinese companies that traded overseas will survive the accounting scandal and shorting crisis, an analyst told chinadaily.com.cn in Beijing on Sunday.

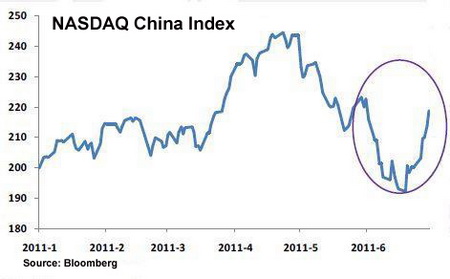

The analyst,surnamed Li, said in a salon held in Peking University that overseas investors had begun to differentiate good apples from bad apples and pick them out. This can be seen from the NASDAQ China Index, which has gained some lost ground since the accounting scandal hit the market.

|

|

The independence and morality of US short seller Muddy Waters, who borrowed stocks in the anticipation of selling them and buying them back at a lower price, is worthy of doubt as on one hand the company released negative reports about Chinese companies and on the other hand, shorted these companies, said Li.

Li said the shorting mechanism is not well-established in the Chinese mainland and, despite recent changes, current regulations allow only 91 of more than 2,000 companies to be shorted, and many of these are industry-wide leaders and not good candidates for short selling.

If the shorting mechanism was expanded, many problems of A-share listed companies would be exposed to the public in the same way as their peers listed overseas, Li said.

But as time goes by, investors would be able to tell good companies from bad ones, he said.

The shorting mechanism would be good for Chinese companies in the long run as, in a way, it would play a supervisory role.

The analyst works with a Shanghai-based securities company but he declined to reveal his company's name or his full name.

E-paper

Burning desire

Tradition overrides public safety as fireworks make an explosive comeback

Melody of life

Demystifying Tibet

Bubble worries

Specials

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

Say hello to hi panda

An unusual panda is the rising star in Europe's fashion circles

My China story

Foreign readers are invited to share your China stories.