Politics

China raises interest rates amid inflation fight

Updated: 2011-07-06 19:11

(Agencies)

BEIJING - China raised interest rates for the third time this year on Wednesday, making clear that taming inflation remains a top priority even as the economic growth pace gently eases.

In a statement on its website, the People's Bank of China, the central bank, said it will raise the one-year yuan lending rate to 6.56 percent from 6.31 percent, and the one-year yuan deposit rate to 3.50 percent from 3.25 percent.

The move, which comes into effect Thursday, follows a PBOC announcement of increases to its benchmark lending and deposit rates on April 5 and February 8, after two such hikes in 2010.

China's consumer price index rose 5.5 percent in May from a year earlier, up from 5.3 percent in April and the fastest pace in nearly three years. Inflation data for June will be released on July 15 and many economists forecast it will hit a new high above 6 percent.

Beijing earlier this year set a full-year target for inflation of about four percent.

The rate rise comes after Premier Wen Jiabao said controlling inflation is the government's top priority, made more pressing after the price of pork -- China's most popular meat -- soared 54 percent year-on-year at the end of May.

"Stabilising the general level of consumer prices remains the top priority of our macroeconomic regulation," Wen said in remarks posted on his government's website Tuesday.

"Prices will be effectively controlled when government policies take effect."

Analysts suggested China was close to, or even at the end, of a cycle of rate rises and the latest move was a pre-emptive strike before another big jump in inflation in data next week heightens depositors' worries about low yields.

"Today's rate hike suggests that China's June inflation could be higher than expected and the second-quarter GDP remains solid, consistent with our expectation," said Ligang Liu, head of Greater China economics at ANZ in Hong Kong.

"The rate hike will help the PBOC to fine-tune its monetary policy by alleviating the worsening negative real interest rate problem so as to prevent an outflow of deposits from the banking system."

Analysts couldn't agree on whether there will be more rate rises in the second half of the year. China has raised banks' reserve requirements nine times in addition to these rate rises in its nine-month cycle of tightening monetary conditions.

"China's inflation battle is almost at an end. Already, there are signs that price pressures are coming off," said Frederic Neumann, an economist at HSBC in Hong Kong. "Today's rate hike may therefore have been the last in the cycle,"

Hopes that the PBOC may be near a pause in tightening was seen as a positive for stocks. Such expectations have helped the Shanghai Composite index bounce from nine-month lows hit in June.

The world's second-biggest economy expanded more than 10 percent last year but has cooled in 2011. First-quarter growth was 9.7 percent and data next week is expected to show the pace eased to 9.4 percent in the second quarter.

E-paper

Shining through

Chinese fireworks overcome cloudy times, pin hopes on burgeoning domestic demand

Pen mightier than the sword

Stroke of luck

Romance by the sea

Specials

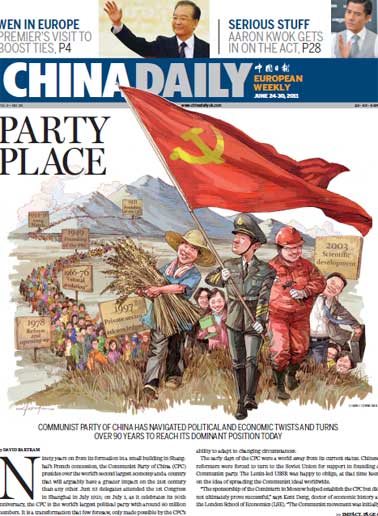

90th anniversary of the CPC

The Party has been leading the country and people to prosperity.

My China story

Foreign readers are invited to share your China stories.

Green makeover

Cleanup of Xi'an wasteland pays off for ancient city