From Chinese media

87 IPO firms raise 96b yuan in Q1

Updated: 2011-04-01 15:18

By Hao Yan (chinadaily.com.cn)

In the first quarter of this year, 87 companies launched on Chinese mainland's A-share market through initial public offerings (IPO) and raised 96 billion yuan, the China Securities Journal reported Friday.

Their total capital raised was 10 percent less than the 107 billion yuan raised during the fourth quarter of last year, when 89 companies went public, and 15 percent less than the 113 billion yuan raised during the first quarter of 2010.

The 87 companies have raised capital 161 percent more than the total amount of plans, which is 36.7 billion yuan. More than 80 percent of the companies' super placement ratios are above 100 percent, while four of them achieved a more than 400 percent super placement ratio, according to calculations by the China Securities Journal.

| ||||

The average price-earnings ratio of the 87 IPO shares increased six percent to 62.9, compared to the same period a year ago.

Ten companies launched on the main board market, 42 on the ChiNext board and 35 on the Shenzhen small and medium-sized enterprises board. The 10 main board companies issued 826 million shares. During the fourth quarter last year, eight main board companies issued 3.3 billion shares.

Sinovel Wind (Group) Co Ltd's IPO on the main board market raised 9.5 billion yuan, the largest amount in the first quarter, and contributed 9.9 percent to the total capital raised by the 87 companies.

BBMG Corp, a Hong Kong-listed company, launched on the Shanghai Stock Exchange in February, but did so by swapping shares with delisted Hebei Taihang Cement Co Ltd.

E-paper

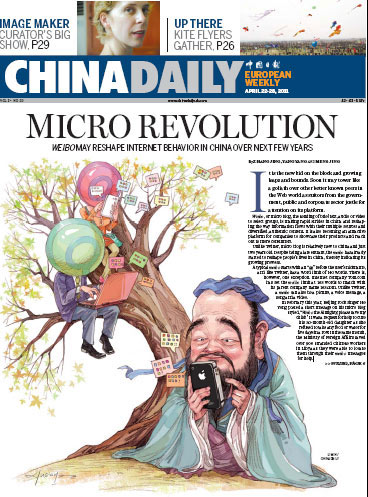

Blowing in the wind

High-Flyers from around the world recently traveled to home of the kite for a very special event.

Preview of the coming issue

Image maker

Changing fortunes

Specials

Costly dream

Uninhabited havens up for lease but potential customers face wave of challenges in developing them.

Models gear up car sales

Beauty helps steer buyers as market accelerates.

Urban breathing space

City park at heart of Changchun positions itself as top tourism attraction