Economy

Executives: Outlook is good for business

Updated: 2011-03-07 07:26

By Wang Xing (China Daily)

Multinationals to increase investment over the next five years, reports Wang Xing in Beijing.

|

|

A busy day at a Walmart store in Shanghai could be duplicated elsewhere. The retail giant plans to expand in second- and third-tier Chinese cities. [File photo by China Daily] |

Shortly after Rio Tinto's China executive Stern Hu was arrested in July 2009 in Shanghai and charged with bribery and stealing business secrets, Ian Bauert got a midnight telephone call at his Australian home. "Hi, Ian," his boss said. "Can you go to China again?"

Bauert was soon on a flight to China. He had started the Anglo-Australian mining giant's first office in Beijing in 1983 and was now taking on the challenge of mending ties between Rio and its biggest customer, China.

| ||||

Bauert, who recently turned 60, said he believes his zodiac year - the Year of the Rabbit - could be exciting for him and his company because China is now more than just a buyer, it is a provider of a more diversified array of opportunities.

His feeling about China's opportunities and challenges are echoed by 69 multinational executives in a survey conducted in February.

Bullish outlook

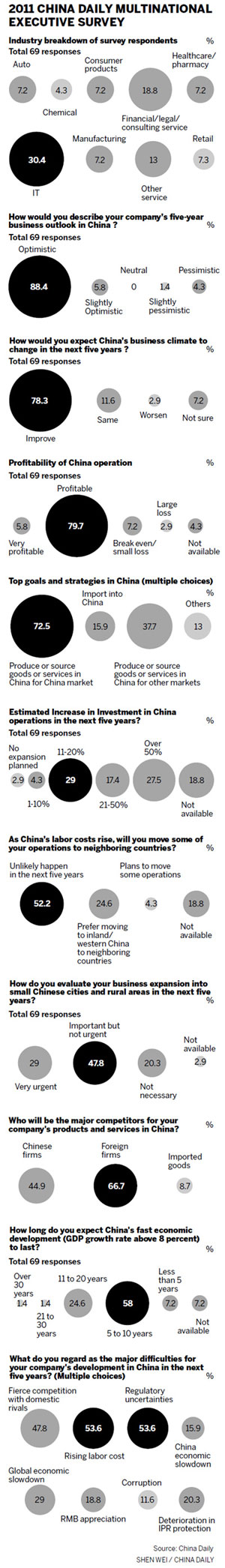

The first China Daily Multinational Executive Survey sought their views about the prospects of China in the coming five years, the period of the 12th Five-Year Plan (2011-2015). The participants were from a wide scope of industries, from automobiles to healthcare, from technology to financial services.

And 94.2 percent of those executives said they are optimistic or slightly optimistic about their business outlook in China. The rest said they are pessimistic or slightly pessimistic.

More than 90 percent of the multinationals plan to increase their investment in China in the next five years - 27.5 percent by more than half.

"China is always an important market. We noticed that in the 12th Five-Year Plan draft, the government plans to encourage domestic consumption. We believe that will provide a great opportunity for retailers like us," said Ed Chan, president and chief executive of Wal-Mart China, who participated in the survey.

He said the world's biggest retailer plans to accelerate its expansion in second- and third-tier Chinese cities in the next five years to tap increasing demand.

In the government report delivered Saturday to the National People's Congress, Premier Wen Jiabao said China is aiming at economic growth averaging 7 percent for each of the coming five years. This follows an average annual growth rate of 11.2 percent in the 11th Five-Year Plan period (2006-2010).

China's GDP stood at 39.8 trillion yuan last year ($6 trillion), overtaking Japan to become the world's second largest after the United States. Wen said the country's economy is likely to grow to 55.8 trillion yuan in 2015 based on 7 percent average annual growth.

In the China Daily survey, many executives were more bullish. Forty of the 69 company officials said the Chinese economy could grow at an annual rate of 8 percent for five to 10 years, while 17 executives said the momentum could last as long as two decades.

Only five of the 69 said the growth rate could last less than five years. Five respondents declined to answer.

"With the rapid growth of its auto and transportation industries, China has become one of the most important markets for us," said Yves Chapot, president of Michelin Group in China and a survey participant. He said the company is full of confidence in the ability of China to move its growth pattern toward domestic consumption.

Business climate

In the Financial Times on July 1, GE CEO Jeff Immelt was reported to have accused China of being protectionist. On July 17, news reports said that Siemens CEO Peter Loscher had told the premier that foreign companies want equal treatment in bidding for public contracts.

Both CEOs said their remarks were not interpreted in the appropriate context. At the same time, top Chinese leaders including Premier Wen Jiabao, President Hu Jintao and Commerce Minister Chen Deming all expressed that China welcomes foreign investors and promised to offer equal playing fields.

The business climate has been a hot topic in the multinational corporate world ever since, especially with rising competitiveness from Chinese rivals.

Fifty-four respondents in China Daily's survey said they expect foreign investment in China to improve in the next five years. Eight said they expect no change, two said the business climate could worsen and five declined to respond.

Despite complaints from some multinationals, their companies are paying increasing attention to China. And their investments have entered the range of billions, not just millions.

In the survey, all executives but two said they were planning to increase investments in China in the next five years. Twenty said their investments could grow 11-20 percent, and 19 put the growth over 50 percent.

In November, Immelt announced that GE would invest $2 billion in China over three years.

Besides tapping Chinese demand for its products and services, the US industrial giant is partnering with Chinese companies to develop US markets. It has agreed to work with Chinese high-speed railway maker CSR to discuss the possibility of providing high-speed railway solutions in California.

Bauert, with Rio Tinto, said a similar shift is on at his company. China is not only a customer for the mining company, but a supplier of heavy-load trucks and other mining materials, he said.

More important, Bauert said, Rio has joined with China Aluminum Corp to develop iron ore mines in Simandou, Guinea, and to survey copper mines in Guizhou province - helping China find and better use mines at home and overseas. That elevates the relationship from supplier-buyer to partnership, he said.

Time to move?

In spite of their ambitions, the executives surveyed by China Daily said rising labor costs and regulatory uncertainties are two major headaches for them. For 37 respondents, those headaches were ranked as major difficulties.

Thirty-one executives raised the issue of tough competition from domestic rivals while 46 said foreign companies were still their biggest concern.

Some executives said they have to transfer technologies to Chinese companies under their partnership agreements, thus growing their own competitors. But a senior manager with GE China, who preferred not to be named, said he sees the issue differently.

"It's a business issue, so there is no point in complaining after you sign the contracts," he said. "The key is whether we have confidence in our innovation and whether we can grow fast enough to keep ahead of competition. It is an issue everywhere, not just in China."

Since labor costs increased last year, concern has grown that China is losing its charm as a destination for foreign investment. Some international companies are reportedly considering moving plants to cheaper Asian markets.

This follows calls for higher pay at some factories of such overseas investors as Foxconn and Honda in southern China.

|

But according to the China Daily survey, 76.8 percent of the multinational respondents said they don't plan to move their operations outside China in the next five years even though they feel the pressure of labor costs.

Among all the respondents, 24.6 percent said they would rather move to inland China than to neighboring countries. Only 4.3 percent said they plan to move out of China.

"During the past decades, China has established a comprehensive industrial support capacity that few neighboring countries can match," said Wang Zhile, director of the research center on transnational corporations under the Ministry of Commerce. He said that Chinese workers' high educational level and skills helped make China an attractive place for manufacturing.

Christina C.N. Cheung, director of South China Holdings Ltd and a member of CPPCC from Hong Kong, told China Daily on Saturday that Hong Kong companies have discussed whether it is worthwhile to move operations on the mainland to other regions, and the conclusion was no.

She said the infrastructure and the size of local markets in Southeast Asian countries, which some analysts consider a hot rival to China, are not as good as China's despite rising labor costs.

"I do not see any significant possibility that companies invested by Hong Kong businesses will leave the mainland, unless the labor cost doubles," she said.

Looking ahead

Some companies are thinking now about moving to China's inland and western regions when the wages in coastal regions grow. Nearly half, 47.8 percent of the respondents, said moving to rural areas is "important but not urgent". Almost 30 percent said that rural expansion is "very urgent" to their businesses.

According to the draft of the 12th Five-Year Plan, China plans to boost the average income of people living in rural areas by 7 percent yearly and will greatly expand health insurance coverage across the country.

Of the executives surveyed, 20.3 percent regarded rural expansion as "not necessary" to their companies. Most of the respondents that don't have rural expansion plans are financial, legal or consulting firms.

"The Chinese leadership is looking at rural areas and underdeveloped areas for the development of new domestic demand, and looking at institutional reforms to remove various distortions that have been responsible for the economic imbalance," Ren Xianfang, senior China analyst from IHS Global Insight, said in a research note sent to media. That, he said, is expected to significantly increase the purchasing power of people living in small cities and rural areas.

Wang Xiaotian, Li Fangfang, Hu Yuanyuan and Cai Xiao contributed to this story.

E-paper

Sindberg leaves lasting legacy

China commemorates Danish hero's courage during Nanjing Massacres.

Crystal Clear

No more tears

Road to the Oscars

Specials

NPC & CPPCC sessions

Lawmakers and political advisers gather in Beijing to discuss major issues.

Sentimental journey

Prince William and Kate Middleton returned to the place where they met and fell in love.

Rent your own island

Zhejiang Province charts plans to lease coastal islands for private investments