Time out called on banks

|

|

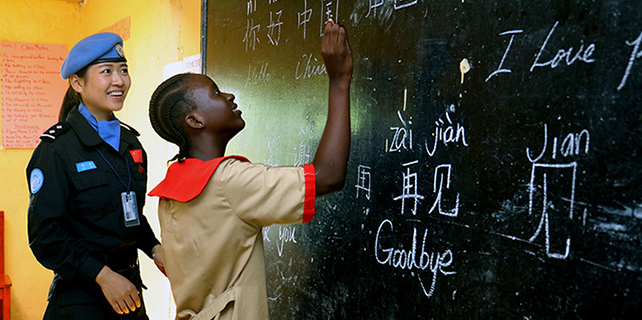

An Inter Milan player poses with a mascot of Suning during a visit to the Chinese retail giant's headquarters in Nanjing, Jiangsu province, on July 19. Suning bought a majority stake in the soccer club last year. [Photo by Claudio Villa/Getty Images] |

Chinese banks will no longer be the financial source for domestic companies to buy sports clubs, hotels, entertainment and real estate businesses abroad-as the country reforms its outbound direct investment policy to ward off risks-according to analysts.

Their comments came after the government reported that Chinese companies invested more than 15 billion yuan ($2.27 billion) in buying foreign sport clubs, mainly in Europe, since 2014. That's even though many football clubs had consecutive annual losses before they acquired them.

Central government branches, such as the State Administration of Foreign Exchange, began to take measures to prevent unwise and even illegal overseas investments by both State-owned and private companies in the fourth quarter of 2016. All ODI activities involving amounts over $50 million must now be approved by policy makers.

"It is fine for companies to buy overseas businesses using their own cash. However, many companies are using bank loans to invest in foreign countries and many of them have high debt ratios and weak earnings abilities," said Yin Zhongli, a researcher at the Institute of Finance and Banking at the Chinese Academy of Social Sciences.

Yin said they also borrowed money from domestic financial institutions to conduct ODI activities. If these failed to secure profits, Yin added, the losses would add potential risk to domestic markets.

Chinese investors have been keen to buy European football clubs over the past few years. The outright purchase of AC Milan, by a Chinese consortium for 520 million euros ($606 million) in April, was among the highest profile deals yet.

Chinese retailer Suning Holdings also bought a majority stake in Inter Milan for 270 million euros ($316.9 million) last year, even though the Italian club had lost a total of 275.9 million euros over the past five years.

Other private giants-including Anbang Insurance Group, Dalian Wanda Group and Fosun Group-have all been big spenders in acquiring foreign real estate, hotels, film companies and sport clubs since 2015.

"The government already warned that some ODI activities in non-real economic business could lead to irrational investments and illegal activities in areas such as asset transfers," said Gao Peiyong, director of the Institute of Economics at the CASS.

Gao said the country may introduce its first regulation of ODI, to better reform the sector and prevent potential cases of irrational investment and money laundering, in the second half of this year.

China's ODI in the nonfinancial sectors fell 45.8 percent year-on-year to $48.19 billion in the first half of this year, data from the Ministry of Commerce showed.

"Growing uncertainties in global business settings, increased prudence by companies making investment decisions overseas, and tightened compliance reviews by regulators on overseas investments are the reason for the drop," said Gao Feng, a spokesman for the Ministry of Commerce.

He said China would continue to support qualified domestic companies investing abroad, especially investments in infrastructure and manufacturing projects related to the Belt and Road Initiative and international deals to boost industrial capacity.