Chinese investors move in, take large slice of Latin American pie

|

|

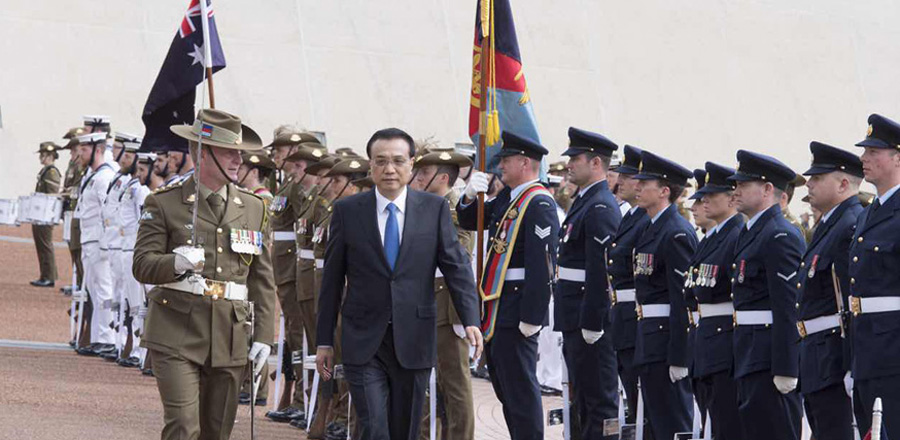

An employee drives a vehicle at leading Chinese steel manufacturer Shougang Group's mine in Peru. [Photo/Xinhua] |

Chinese companies are forming the mainstay of foreign direct investment in Latin American and African markets as globalization suffers setbacks elsewhere, an international law firm has said.

In an interview with China Daily, Juan Picón, global co-chairman of DLA Piper, said he still thought the trend would continue, based on feedback from his clients.

He said: "A growing percentage of our clients who are investing directly in Latin America are from the Chinese mainland, from sectors including energy, infrastructure and technology and so on."

A similar situation could also be seen in Africa, he said.

According to Reuters, the United Nations trade and development agency UNCTAD, reported that global foreign direct investment fell by 13 percent to an estimated $1.52 trillion in 2016.

The report stated that the US was the top destination with $385 billion, rising by 11 percent year-on-year, followed by the UK ($179 billion) and China ($139 billion).

Europe saw a fall of 29 percent, followed by Latin America and Africa in overall terms.

But Picón noted a rising interest from the Chinese government and corporations in fostering relations with countries in Latin America and Africa.

China's investment in those regions is expected to gain greater momentum with China's Belt and Road Initiative.

DLA Piper was formed in 2005 by a merger between three law firms, two based in the US and one in UK.

Picón said there were still many large projects to develop in Latin America, requiring massive funding programs, such as various national infrastructure projects.

He added that Latin America had always been very investor friendly with fewer limitations on foreign direct investment.

DLA Piper currently has represented more than 30 Chinese mainland companies, easing their clients' entry to industries including financial services, infrastructure, telecoms, engineering and agriculture.

Transportation and energy-related infrastructure projects have proven more attractive to his Chinese clients in countries such as Mexico, Peru, Chile and Cuba.

In foreign direct investment in Latin America, Picón said, the US used to dominate the market. But as time goes by, Latin America's relationship with China is building to "a more mature stage".