HK's insurance stocks take a hit

Updated: 2016-11-01 07:42

By Chai Hua in Hong Kong(China Daily)

|

|||||||||

Shares retreat after UnionPay tightens up on payment system for products sold in sector

Insurance companies' shares fell in Hong Kong on Monday, after mainland's biggest bank card provider Unionpay tightened up on payments for Hong Kong insurance products over the weekend.

Major players AIA Group Ltd and Prudential Plc fell 4.77 percent and 2.8 percent respectively in Hong Kong at the close of trading on Monday.

On Oct 28, a story saying Unionpay International would suspend all insurance payment access in Hong Kong made a splash in mainland media and many mainlanders rushed to the SAR to catch the last opportunity-some even by plane.

A Hong Kong insurance agent surnamed Yip told China Daily that a client who was considering signing an insurance policy immediately went to Hong Kong to make the deal on Friday night after hearing the news.

The client swiped his Unionpay card over 300 times to finish the payment for his life insurance, Yip said.

UnionPay in February capped overseas insurance product purchases at $5,000 per payment.

He said almost all clients choose to swipe the Unionpay card for the first payment, which is usually a large amount, but now most insurance agencies in Hong Kong have suspended the payment method, so he worried many of his "big clients" would quit after "the most convenient payment method had disappeared".

An agent in Hong Kong for Prudential, a UK insurance company, confirmed payments of around 20,000 yuan ($2,940) for policies could still be made with the Unionpay card.

Unionpay International denied on Saturday it had launched any new regulations, saying that payment with Unionpay for investment insurance product has always been forbidden, but it can be used to purchase travel, accident and disease policies.

Unionpay said in a statement that it found that the transaction volume of some overseas insurance companies sharply increased recently, so it needed to reiterate its supervision regulations.

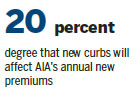

The latest curbs will affect more than 20 percent of AIA's annualized new premiums, a gauge of new policy sales, in Hong Kong. They will reduce AIA's overall new business value, the projected profitability of new policies, by about 5 percent, China International Capital Corp was quoted as saying by Bloomberg.

Compared with mainland products, Hong Kong's insurance policies offer higher returns, so they are popular among mainlanders, said Ju Lan, director of the Risk Management and Insurance Research Center at the Shenzhen-based HSBC Business School of Peking University.

But she said the reason for the remarkable surge in mainland investors this year was the renminbi's depreciation.

She said it becomes a method to avoid risks and allocate their assets globally because Hong Kong insurance are assets in Hong Kong dollars, while the yuan is expected to weaken further.

grace@chinadailyhk.com

(China Daily 11/01/2016 page13)

Today's Top News

S. Korean prosecutors arrest president's confidante

Premier to visit Central Asia and East Europe

Police swoop on Paris migrant camp

Email probe takes toll on Hillary's campaign: poll

Strongest quake in decades hits central Italy

EU, Canada sign landmark deals

Party ramps up supervision

Queen Elizabeth visits new town Poundbury

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|