IMF announces RMB in SDR starting on Oct 1

Updated: 2016-09-30 15:50

By CHEN WEIHUA in Washington(chinadaily.com.cn)

|

|||||||||

|

|

International Monetary Fund Managing Director Christine Lagarde announces on Friday the launch of the new IMF Special Drawing Right (SDR) valuation basket that includes the Chinese currency yuan for the first time. [Chen Weihua/China Daily] |

The International Monetary Fund (IMF) announced on Friday that its Special Drawing Rights basket of currencies will for the first time include the renminbi (RMB) as of Oct 1, the start of China's National Day holiday.

"The expansion of the SDR basket is an important and historic milestone for the SDR, the Fund, China and the international monetary system. It is a significant change for the Fund, because it is the first time since the adoption of the euro that a currency is added to the basket," IMF Managing Director Christine Lagarde told reporters at the IMF headquarters in Washington on Friday.

As approved by the IMF Executive Board on Nov 30, 2015, the RMB, also known as the yuan, is determined to be a freely usable currency and will be included in the SDR basket as a fifth currency effective Oct 1, along with the US dollar, the euro, the Japanese yen and the British pound.

The board also decided at the time that the weights of each currency would be 41.73 per cent for the US dollar; 30.93 percent for Euro; 10.92 per cent for the RMB, also known as the yuan; 8.33 per cent for the Japanese yen and 8.09 per cent for the British pound sterling.

"The renminbi inclusion reflects the progress made in reforming China's monetary, foreign exchange, and financial systems, and acknowledges the advances made in liberalizing and improving the infrastructure of its financial markets," Lagarde said.

"The continuation and deepening of these efforts, with appropriate safeguards, will bring about a more robust international monetary and financial system, which in turn will support the growth and stability of China and the global economy," she said.

The fifth most-powerful woman in the world, according to Forbes magazine, said this milestone also reflects the ongoing evolution of the global economy. "The Fund plays an important role in this evolving process, and the inclusion of the RMB in the SDR basket shows once again that the Fund stands ready to adapt to change," said Lagarde, who began her second five-year term in July.

|

|

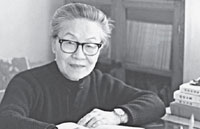

International Monetary Fund Managing Director Christine Lagarde (center) poses with the Chinese team at IMF on Friday after announcing the launch of the new IMF Special Drawing Right (SDR) valuation basket that includes the Chinese currency yuan for the first time. [Chen Weihua/China Daily] |

Lagarde thanked the Chinese team at the IMF, including the new IMF deputy managing director, Zhang Tao.

"Inclusion of the RMB in the SDR is an important signal that China has made a lot of progress with financial reform and the RMB has become an international currency," said David Dollar, a senior fellow at the John L. Thornton China Center of the Brookings Institution in Washington.

He said in order to be a major reserve currency, China needs to continue reform, strengthening transparency and reliability of capital markets and opening up more to the global economy.

Rory MacFarquhar, a visiting fellow at the Peterson Institute for International Economic and a former senior official at the White House National Security Council, said the inclusion of the RMB in the SDR is putting new responsibility on China.

"Those basically come down to the way China thinks of its currency, thinks of its economic management as in global terms," he said.

"The decision is very good for China, IMF and international financial system," said Eswar Prasad, the Tolani Senior Professor of Trade Policy at Cornell University. The former IMF chief in China believes it will be good for pushing forward China's internal reform, especially in the financial sector.

He also believes it's good in terms of making China a stakeholder of IMF and bringing on board the emerging markets, which feel somewhat unfairly treated in the international financial governance.

On Friday, the IMF Board also decided that effective on Oct 1, the value of the SDR will be the sum of the values of the following amounts of each currency, namely US dollar, 0.58252; Euro, 0.38671; Chinese yuan, 1.0174; Japanese yen, 11.900; Pound sterling, 0.085946.

chenweihua@chinadailyusa.com

Today's Top News

China seeks UK nuclear approval after Hinkley deal

E-wallet services bloom at airports

British retailers brace for rush during Golden Week

1 dead, 26 missing in East China landslide

MH17 missile came from Russia:Investigation

Sheffield research to help China's space plan

Royal couple continue their charmed tour in Canada

Russia unveils Syria truce deal with US

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|