Bank in lackluster Hong Kong debut

Updated: 2016-09-29 06:58

By Luo Weiteng(China Daily)

|

|||||||||

|

|

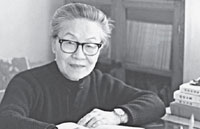

Postal Savings Bank of China Chairman Li Guohua (left) and Executive Director and President Lyu Jiajin pose with a gong during the listing of the bank at the Hong Kong Stock Exchange on Wednesday. [Photo/China Daily] |

Lender's president says it may soon be in Hang Seng China Enterprises Index

State-owned Postal Savings Bank of China made a lackluster stock market debut on Wednesday in Hong Kong, despite notching up the world's largest initial public offering in two years.

Shares of the Beijing-based lender fluctuated in a tight range of HK$4.76 (61 cents)-HK$4.77, after opening flat with its initial offer price at HK$4.76 apiece. It ended its first trading day at HK$4.77.

The bank raised $7.4 billion in Hong Kong, a mega deal which was the biggest IPO globally since mainland internet behemoth Alibaba Group's $25-billion offering in 2014.

Postal Savings Bank Chairman Li Guohua said at the listing ceremony in Hong Kong on Wednesday that the bank will plough 10 percent of its future net profits into dividends.

He said he believed the bank's sheer size would mean that it will be included in the Hang Seng China Enterprises Index very soon, when mainland investors could buy and sell its shares through southbound trading on the cross-border stock connects.

The tepid stock performance in the very first trading day may reflect lingering market concern over its above-average valuations, noted Xu Xueming, the bank's vice-president.

Even although the megabank priced its IPO near the bottom of a marketing range of HK$4.68 to HK$5.18 per share, its price-book ratio of 1.2 makes the stock overvalued compared with mainland lenders typically priced at around 0.8 times their book value.

For the first three months of the year, the lender's nonperforming loan ratio remained low at 0.81 percent, dwarfing the average 1.73 percent for the mainland's four major State-owned commercial banks.

Previously completely State-owned, Postal Savings Bank of China raised 45.1 billion yuan ($6.8 billion) by selling a 16.92 percent stake to 10 high-profile strategic investors at a cheaper valuation of $40.6 billion.

"Such a buying spree among institutional investors comes in a sign that the stock is viewed as a worthwhile investment," said analysts from Bank of East Asia's securities branch.

Following the trail blazed by China Zheshang Bank's $1.9 billion float and Bank of Tianjin's $989 million offering in March, the mainland's financial services sector continues to be the catalyst for the Hong Kong IPO market.

But this also raised the much-discussed issue of diversifying new share listings in Hong Kong.

"A diversified IPO market is something that the government has no control over. It should be decision for the market," said Hong Kong Financial Services and Treasury Secretary Chan Ka-keung.

"The SAR government will discuss with Hong Kong Exchanges and Clearing Ltd on how to attract new types of companies to float in HK."

Related Stories

Postal Savings Bank IPO seeks up to $8.1b 2016-09-14 08:19

Brokers' new issues sputter on low profits 2016-09-28 07:58

Consolidation's the 'A' game 2016-09-26 08:19

Scouring social media for 'tips' 2016-09-12 07:33

Insurance funds allowed in Shanghai-HK stock connect 2016-09-09 07:29

Today's Top News

MH17 missile came from Russia:Investigation

Sheffield research to help China's space plan

Royal couple continue their charmed tour in Canada

Russia unveils Syria truce deal with US

Poll suggests Clinton winner of 1st presidential debate

Top official: China goes beyond its own interests

Russian ice creams hot in China

Renminbi use surges in London in spite of Brexit

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|