Baidu set to lose leading role in digital advertising

Updated: 2016-09-23 09:44

By MENG JING/HU MEIDONG(China Daily)

|

|||||||||

|

|

A smartphone showing the Baidu Browser application is seen in this picture illustration, February 22, 2016. [Photo/Agencies] |

E-commerce heavyweight Alibaba has so far notched up a 28.9 percent share of China's digital ad market, equating to $12.05 billion, said eMarketer, which researches digital marketing, media and commerce.

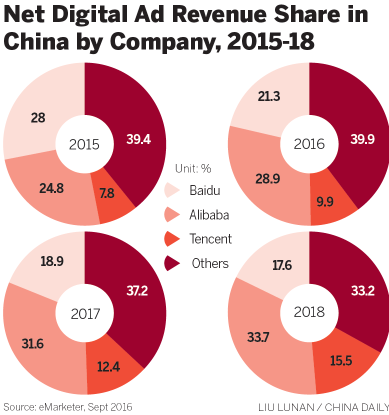

In previous forecasts eMarketer had predicted that Baidu, which uses search result listings to generate income from advertisers, would stay out in front. Last year, Baidu earned 28 percent of China's digital advertising revenue, compared to Alibaba's 24.8 percent.

But eMarketer has downgraded its outlook for Baidu this year as it has witnessed challenges in the past few months due to tighter government controls on search result advertising. Baidu's digital ad revenue is expected to see sluggish growth this year of just 0.3 percent to $8.87 billion. Meanwhile, Alibaba and Tencent Holdings Ltd will continue to surge ahead and report increases of 54 percent and 68 percent, respectively.

Baidu, Alibaba and Tencent, the top three firms in China's internet industry are estimated to take a total of 60 percent in the country's digital ad revenue of $41.66 billion in 2016.

But the government's tightened controls on online advertising are only part of the reason for Baidu's slowing ad revenue. Analysts said that the Beijing-based Baidu's lack of strong mobile products is another factor affecting its ability to attract advertisers.

Shelleen Shum, an analyst from eMarketer, said the tighter regulation of internet advertising is expected to weigh heavily on Baidu's search revenues in the near term.

"Although also affected by the new regulations, Alibaba's ad revenue, particularly from the mobile sector, shows no sign of abating thanks to the robust growth of its e-commerce retail business," she said.

Baidu's net income for the quarter ending June 30 was 2.4 billion yuan ($359 million), down 34.1 percent year-on-year, as the company dealt with the impact of tougher controls on internet advertising and in the healthcare sector.

"Huge traffic is the bedrock of online advertising business. But unlike Alibaba and Tencent, which have numerous successful mobile products that can attract traffic from users. Baidu still lacks a new cutting-edge to help jumpstart its slowing traditional search business," said Lyu Ronghui, an analyst with internet consultancy iResearch Consulting Group.

Apart from e-commerce, Alibaba's cloud computing business is growing rapidly to help turn enterprises user into advertisers while Tencent has been gearing up to monetize its popular app WeChat and has a thriving gaming business which can also make money on advertisement.

Today's Top News

State of emergency declared in US city amid protests

Universities given boost in rankings

Demand for Mandarin rises in UK

China 'capable of keeping medium-to-high growth'

Li tells Obama of opposition to THAAD deployment

Greek vows to improve refugee situation on island

UN suspends aid convoys following deadly strikes

New York bombing suspect captured in New Jersey

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|