Real estate market to see short-term adjustment: CASS

Updated: 2016-07-07 13:57

By Yu Xiaoming(chinadaily.com.cn)

|

|||||||||

|

|

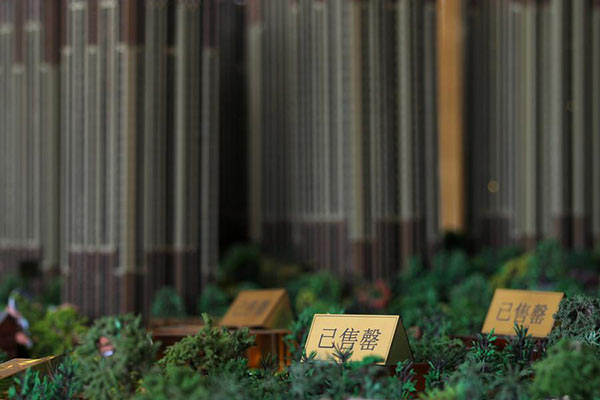

Models of residential buildings are seen at a property showroom in Chenggong district of Kunming, Yunnan province, April 14, 2016. The Chinese characters on the boards read "already sold out". [Photo/Agencies] |

The property market is expected to see a short-term adjustment from the second half of 2016 to the first half of 2017, and developers may face credit default risk due to fragile capital chain, Economic Information Daily reports.

Since the second half of 2015, the real estate market has shown signs of recovery due to stong policies to stimulate it, Associate Director Ni Tengfei said.

However, this round of rebound will not last long because there is no other support, the newspaper said citing a report released by the National Academy of Economic Strategy, a research group of the Chinese Academy of Social Sciences.

In terms of supply side, new investment is likely to turn into a large new supply this year due to huge unsold inventories and less pressure in fund withdrawal.

So if effective system reform is not implemented, the potential demand cannot be relieved, and a short-term adjustment is inevitable, Ni said.

During the first four months of this year, home sales in major cities were 10 percentage points higher than non-major cities, however, developers' investment in non-major cities was 1.1 percentage points higher than that of major cities.

Developers' credit default risk will increase accordingly during the adjustment period, Ni added.

Data showed that between February and May, individual mortgage loans among developers' capital source increased by 30.4 percent, 46.2 percent, 54.7 percent and 58.5 percent year on year respectively. However, the figures were all negative between April and December of 2014.

Ni warned that developers in third- and fourth-tier cities may run out of money and could be at a risk due to the fragile capital chain, especially the default risk of some small and medium developers who raised money through informal financing.

Related Stories

Land prices in major China cities go soaring 2016-06-25 14:35

China's home price growth moderates in May 2016-06-18 11:36

Second-tier cities in home buying craze 2016-06-17 17:22

Official denies property suspension rumors 2016-06-15 13:40

Chinese listed property developers post record indebtedness 2016-06-03 16:40

Today's Top News

Chilcot report: Iraq war based on flawed intelligence

UK invasion of Iraq was not last resort: Report

Berlusconi accepts Chinese offer for AC Milan

UK consultancy loses license, Chinese graduates being told to leave

Chinese online retailers offer 'Brexit sales' as sterling hits record lows

British PM race cut to 3 hopefuls

Suicide bombers hit three Saudi cities

Response to 'fully depend' on Manila

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|