Swimming through troubled waters

Updated: 2016-06-17 08:32

By Zhong Nan(China Daily Europe)

|

|||||||||

Zhang Yongfeng, deputy director of market research at the Shanghai International Shipping Institute, says Chinese ship-breaking yards have been adopting new technologies to carry out their work, which involves higher costs for equipment, materials, storage and workers' protective wear.

Compared with China, other major ship-breaking countries such as Turkey, India and Bangladesh are still relying on manual methods and outdated equipment to dismantle ships. Many scrap vessels are even dismantled on beaches.

Zhang suggests the Chinese government should consider offering more encouraging policies such as tax cuts or financial help for those buying steel-cutting equipment or materials, as many ship-recycling companies bear heavy financial burdens in operating their businesses in an environmentally friendly manner.

"It was like riding a roller coaster," says Yang Jianchen, general manager of Zhoushan Hongying Shipbreaking Co. "The period between 2006 and 2013 was good for the industry. The decline in global steel prices, including scrap, has pushed many ship-breakers in Zhejiang into the red."

Yang says as China's steel products are being shipped to many developing countries such as India, Brazil, South Africa and Turkey at lower prices compared with previous years, it has pulled down the price of domestic-made steel products. It has also affected scrap prices.

A typical scrapyard used to employ 230 workers in 2013. The number has plummeted to around 170 due to cost-cutting, delayed payments and attrition.

Yang says even though the government offered subsidies to ship-breaking companies to buy vessels, it is extremely hard to make a profit. Plus, banks are not willing to lend because they are aware how sluggish the business is. "Just like shipbuilding, ship-breaking is listed as a high-risk industry by banks," he adds.

Official data show China's ship-breaking industry's revenue dropped 15 percent to 3.4 billion yuan last year.

Wu Jun, vice-president of the China National Ship Recycling Association, says because China is taking action to scale down infrastructure and real estate investment, while at the same time using restrictive measures to cut production capacity in its steel plants, the country does not need a large amount of scrap as a source of steel.

"Under such circumstances, it would be cumbersome for Chinese ship-breaking yards to sell scrap even at bargain prices to the market this year," Wu says. "Last year was the fourth consecutive year that the industry suffered financial losses."

The association's findings show that China, as the world's largest recycler of material from ship-breaking yards, dismantled 5.1 million dead weight tons last year, accounting for 22.14 percent of the global total. India, Bangladesh, Pakistan and Turkey were its main rivals in this business.

Chinese companies signed contracts with domestic and foreign shipowners to dismantle 6.84 million DWT of scrap vessels last year, down 28.7 percent from the previous year.

"The relatively high prices of both foreign and domestic scrap ships are also cutting the profit margins of Chinese companies, as many have been reporting financial losses for the past several years," says Zhao Ying, a researcher at the Institute of Industrial Economics in Beijing.

China's ship-recycling yards are mainly in Zhejiang, Jiangsu, Shandong and Guangdong provinces, collectively employing around 120,000 workers. These jobs are now under threat.

The drop in scrap prices has seen companies storing supplies in increasing amounts, rather than offloading it cheaply to steel plants, Zhao says.

Affected by low commodity and crude oil prices, the China National Ship Recycling Association says the number of bulk vessel and offshore oil rigs actually being dismantled has grown more than 30 percent in the past year, adding to the oversupply of underpriced scrap.

The Baltic and International Maritime Council, which is based in Copenhagen and is the world's largest international shipping association, predicts this year will be the busiest year for breaking of dry ships. Around 40 million DWT of bulk ships will be dismantled, up 25 percent year-on-year, it says.

zhongnan@chinadaily.com.cn

|

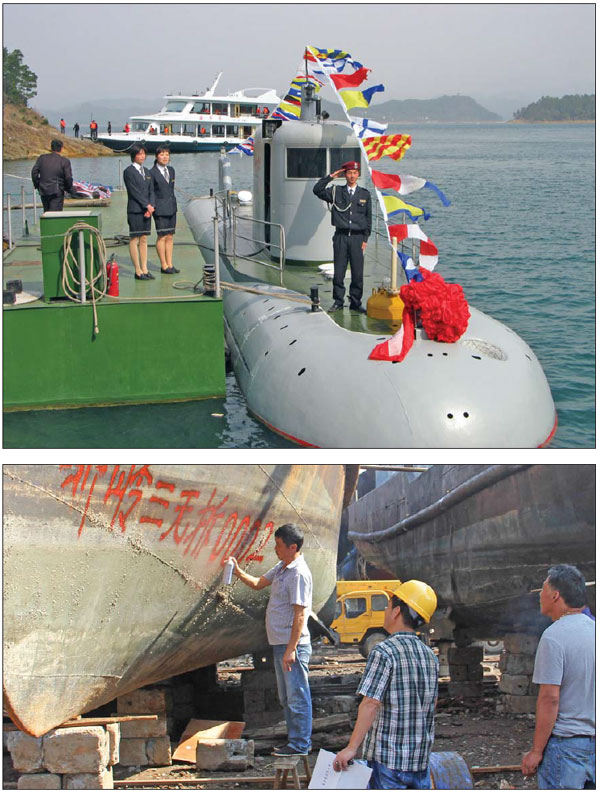

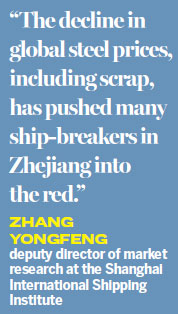

TOP: A CREW MEMBER salutes passengers set to board a sightseeing submarine built by the Wuchang Shipbuilding Industry Group Co in Hubei province. Deng Jia / For China Daily Above: WORKERS mark a ship for dismantling in Taizhou, Zhejiang province.[Photo by Jiang Wenhui / For China Daily] |

Today's Top News

Goals may need revision

Brexit strategy

UK Health Minister comes down on staying in the EU

China, Europe urged to set free trade timetable

Xi's visit to boost partnership projects

First Disney resort in Chinese mainland opens

Killing of policeman 'incontestably terrorist act'

Cultural exchange photo exhibition opens in Poland

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|