Record quarter for outbound M&As

Updated: 2016-04-29 08:27

By Shi Jing in Shanghai(China Daily Europe)

|

|||||||||

Chinese companies spent a record amount on overseas M&As in the first quarter of this year, data released by Morning Whistle Group show.

The Shanghai-based company, which tracks mergers and acquisitions, says 206 purchases were recorded January to March, up 77.59 percent year-on-year. Of the 135 that were disclosed to the public, the total transaction amount was $73.19 billion, a year-on-year increase of 86.08 percent.

Chinese investors' interest in M&As started to become evident in the fourth quarter of last year, which saw 147 overseas acquisitions. The details of 107 were released, showing transactions totaled $129.5 billion.

"Chinese companies are becoming big buyers globally," says Wang Yunfan, chief executive of Morning Whistle. "Even though the market has expressed some doubt about such acquisitions, I think this is the path Chinese companies must take to seek sustained growth."

In developed markets such as Europe, the United States or Japan, the overseas assets allocation rate remains about 40 percent, the company's data show. For China, it is just 8 percent. "Integration of the world economy is a trend of our time. If (Chinese companies) do not participate, they will always be at the bottom of the value chain," Wang says.

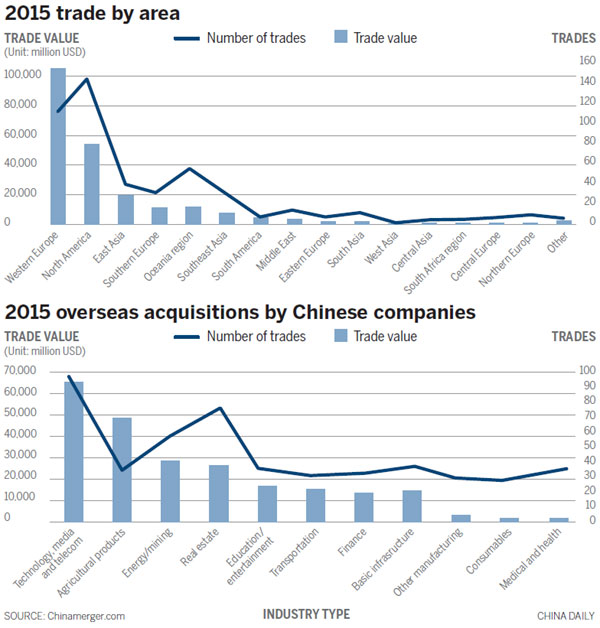

Morning Whistle says technology, media and telecommunications, as well as agriculture and food, and energy and minerals were the three biggest sectors in which Chinese companies invested overseas last year.

In terms of destination, Western Europe attracted the most money, with 102 acquisitions. Those released to the public accounted for 46.58 percent of all investment abroad in 2015.

In March last year, Chinese conglomerate Fosun International Ltd bought 98 percent of French resort brand Club Med for 1 billion euros.

A survey by Morning Whistle in the fourth quarter last year showed Germany was the most popular investment destination among active buyers, with 127 of those surveyed showing an interest in the nation's companies.

Henry Cai, chairman of private equity firm AGIC Capital, says the industrial system built up by small- and medium-sized German companies is a core element that Chinese companies should have a basic understanding of before they make any acquisition in Germany.

shijing@chinadaily.com.cn

( China Daily European Weekly 04/29/2016 page25)

Today's Top News

Testing times

Big hopes as China hosts the G20

Inspectors to cover all of military

Britons embrace 'Super Thursday' elections

Campaign spreads Chinese cooking in the UK

Trump to aim all guns at Hillary Clinton

Labour set to take London after bitter campaign

Labour candidate favourite for London mayor

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|