BP joins hands with CNPC to tap into shale gas potential

Updated: 2016-04-06 08:16

By Lyu Chang and Yang Ziman(China Daily)

|

|||||||||

BP Plc is joining hands with China National Petroleum Corp to unlock the potential of China's vast reserves of shale gas in the hope that it can generate a lucrative profit amid expectations of a rising oil price in the long term, an expert said on Tuesday.

The London-based energy giant signed its first shale-gas production deal with CNPC, the country's biggest oil company, to jointly develop the Neijiang-Dazu shale-gas block covering an area of about 1,500 square kilometers in the Sichuan Basin.

CNPC will be the operator of the project, while BP will use its technology in shale-gas exploitation. Calling it a win-win situation, Bob Dudley, BP Group's chief executive, said that the contract provides "fair and reasonable returns" for both companies.

"The timing is good, and it fits China's national agenda," he said. "There are a lot of known shale-gas resources in Sichuan. It has had some development and a good market for natural gas, and has infrastructure pipelines in place. These are key ingredients for success."

Dudley said geologists have identified places with good prospects in Sichuan, where the country's two biggest shale-gas developments are located, including CNPC's Changning-Weiyuan national shale-gas demonstration area and the Fuling shale-gas project of China Petrochemical Corp, known as Sinopec.

The deal comes at a time when the production of shale gas has declined amid plummeting crude prices, which have led to falling sales of shale gas.

Earlier reports said CNPC and Sinopec produced about 5.1 billion cubic meters of shale gas in 2015, lower than the target of 6.5 billion cu m set in 2012.

"The decision on shale-gas development came unexpectedly, especially when crude oil prices show no sign of bouncing back at least for the next two years," said Li Li, research director of energy consultancy ICIS China.

The contract also follows a pullback of international oil companies such as Royal Dutch Shell Plc and the US-based ConocoPhillips due to the country's challenging geology and mixed drilling results, according to Bloomberg.

But Li said despite China still being in the early stage of a shale fracking revolution, shale gas is a strategic industry for the country to combat air pollution and reduce the reliance on imported oil.

"Shale-gas exploration posts challenges but is of strategic importance. It will generate huge business potential in the long term," she said.

The deal is part of a framework agreement signed in October during President Xi Jinping's visit to the United Kingdom. In addition to unconventional resources, the framework agreement covers possible fuel retailing ventures in China, exploration of oil and LNG trading opportunities globally and carbon emissions trading as well as sharing of knowledge around low-carbon energy and management practices.

BP's 2016 Energy Outlook forecasts that shale gas will make up a quarter of the total gas produced in the world by 2035 and China will contribute most to the sector's growth in that time.

Sinopec plans to boost shale-gas output capacity at its Fuling project to 10 billion cu m by 2017. The company said earlier the first phase of the Fuling shale-gas project in the Sichuan Basin has commenced production with an annual capacity of 5 billion cu m.

Related Stories

BP and CNPC sign shale gas agreement 2016-04-05 11:37

CNPC, COFCO join hands to boost sales 2016-03-16 07:47

CNPC to boost natural gas output this year 2016-01-23 08:08

Shale gas industry on the rise in China 2015-12-31 10:37

China's largest shale gas project goes into production 2015-12-29 14:25

Today's Top News

Li: Tax reform to boost vitality of real economy

First wave of migrants returned to Turkey

Once-endangered pony makes comeback

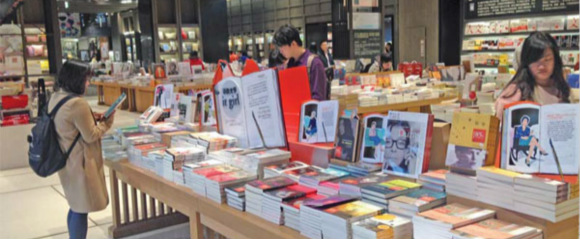

Bookshop worms way into community

A fresh start

Bookshops reinvent themselves

Xi-Obama bilateral talk to advance ties

Foreign companies reassured on new Internet rules

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|