AIIB chief rules out China veto power

Updated: 2016-01-27 05:01

By FU JING in London(China Daily)

|

|||||||||||

|

|

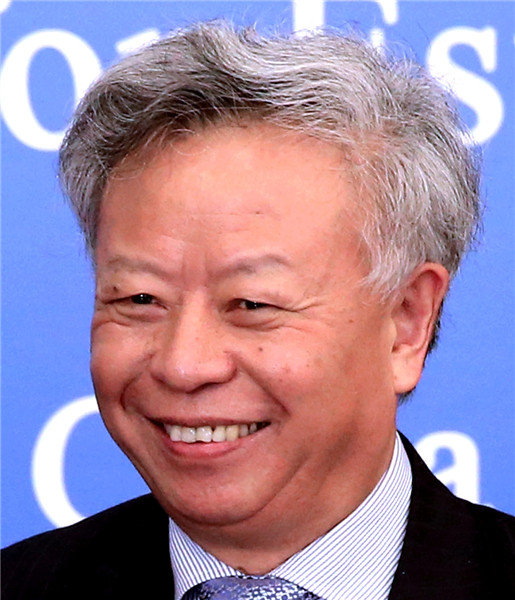

Jin Liqun,president of Asian Infrastructure Investment Bank. [Photo/China Daily] |

China has no intention of exercising its veto power over the newly established 57-member Asian Infrastructure Investment Bank, according to the lender's president.

This is despite the fact that the country has this right because of its economic size, Jin Liqun said.

“There are still many countries on the waiting list, and when the new members join, China’s voting power will be reduced. Such de facto veto power will be lost gradually,” Jin said.

He was speaking to China Daily at the annual meeting of the World Economic Forum in Davos last week.

Members of the AIIB, which has been set up after two years of negotiations, have agreed on a crucial decision-making process by introducing a “fixed” special majority, comprising two-thirds of the number of members and representing three-quarters of the voting power.

China, the largest AIIB shareholder, now holds 26.6 percent of the voting power, Jin said. “We will not increase the special majority to keep China’s veto power in the future,” he said.

Jin said this is a major contrast to older institutions such as the World Bank, in which the United States has maintained its veto power by amending the articles of agreement. This increased the special majority when its voting power was reduced after new members joined.

Jin said that when China put forward the idea of setting up the AIIB, many doubts and concerns were expressed, but the bank has now become accepted by many countries.

“This is the process of China gaining credibility and building up mutual trust by collective consultation and making decisions on democratic approaches,” he said.

But he said that the bank’s inauguration is just the first leg of a long journey and that the most important thing is to recruit staff members to make his words become a reality by meeting the infrastructural demands of countries in need.

He said the bank has not started to recruit new staff members, but he aims to seek between 100 and 150 professionals worldwide this year.

“There is no rush to expand and we need to look for qualified talent and experts carefully,” Jin said. The bank currently has a staff of 50.

Unlike the World Bank and Asian Development Bank, which have sometimes set up offices in different countries, the AIIB will call on the experience of the private sector and assign experts and staff members in each business field, Jin said.

“When there are projects in a country, we will send our staff there, and when the projects are completed, we will leave,” he said.

When the number of projects increases in a country or region, Jin said the bank will probably set up a regional hub or liaison office.

“But we will avoid duplication between headquarters and regional hubs in decision-making,” he said.

Related Stories

Former UK minister tipped to be named an AIIB vice president, FT says 2016-01-26 18:48

AIIB chief vows to run clean, lean, green institution 2016-01-24 11:44

AIIB a test for China's new international role 2016-01-24 11:44

Blog: The promise of the AIIB 2016-01-20 09:11

AIIB attracts global investors

2016-01-20 08:46

Today's Top News

UK adventurer dies on solo journey

Families of expats in China can stay longer

China's growth envy of developed world

Foreigners find hard to buy China's rail tickets

Rags to riches saga underlines China's transformation

Leaders address Iran's thirst for growth

UK's interest in China boosted by BBC TV series

Global push

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|