Coping with the rising cost of after-school education

Updated: 2015-12-02 07:51

By Shi Jing in Shanghai(China Daily)

|

|||||||||||

|

|

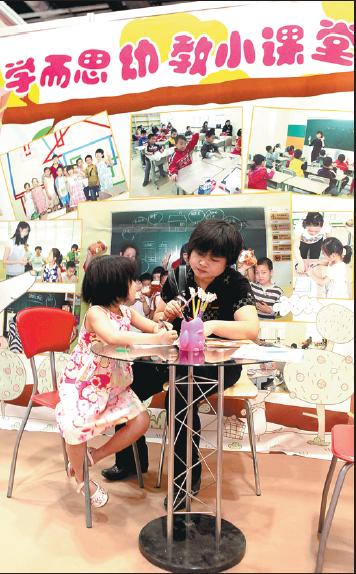

TAL Education Group's booth at an education fair in Beijing.[DA WEI/FOR CHINA DAILY] |

"Second quarter results have exceeded the management team's expectation," Luo Rong, chief financial officer at TAL Education, said. "Among the 18 cities outside Beijing, nine of them achieved 100 percent growth rates."

In September, the company bought First Leap, an English-language training organization for children aged between two to 15, for an undisclosed figure. This will help TAL Education focus more on K12 education and help boost revenue streams.

"The next step TAL will take will be to promote online educational centers as well as offline education," Luo said.

Another major Chinese player, Xueda Education Group, is also listed in New York.

The company is well-known for its individual tuition, which can cost at least 1,000 yuan for five hours.

"Every student will take an entrance exam before the organization decides which level of class he or she should attend," Chen Mingyou, an educational consultant at Xueda Shanghai, said.

"If students cannot attain the results which parents expect, Xueda will refund some of the tuition fees."

But this policy has come under fire from certain parents. In 2012, Xinhua news agency reported that the company's after-school classes in Chongqing and Wuhan in Hubei province did not provide the courses or the teachers they advertised.

Parents also complained that they were overcharged. When asked to comment on this, Xueda pointed out it had conducted an investigation into the matter without going into details.

The company's stock price has reflected those concerns. Xueda opened at $14.3 when it was first listed in 2010. Five years later, it is now around $5, despite rumors in July that the company could go private again.

Major shareholder Xiamen Insight Investment Co Ltd have been involved in merger talks. But as it stands, Xueda is likely to raise additional investment from the market to solve rising costs in its one-on-one teaching model.

Related Stories

English-training schools learn lessons and reap rewards 2015-11-18 07:48

Internet courses go through learning curve 2015-10-12 10:07

Top 10 most expensive schools in Shanghai 2015-09-07 06:36

After 20 years in business, it is time to go back to school 2015-07-28 09:33

Online teaching platform gains major investment 2015-06-11 20:01

Today's Top News

Chinese companies invest in City Football Group

Investment expected as Xi arrives in Zimbabwe

Xi's Zimbabwe visit to elevate bilateral ties to new high

Xi says climate summit a 'starting point'

Xi warns against mentality of zero-sum game

What world leaders say about the planet's future

Xi meets Obama ahead of climate conference

EU, Turkey sign deal to stem migrant flows

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|