Industrial profits dip 4.9% in October

Updated: 2015-11-28 09:00

By Chen Jia(China Daily)

|

|||||||||||

|

|

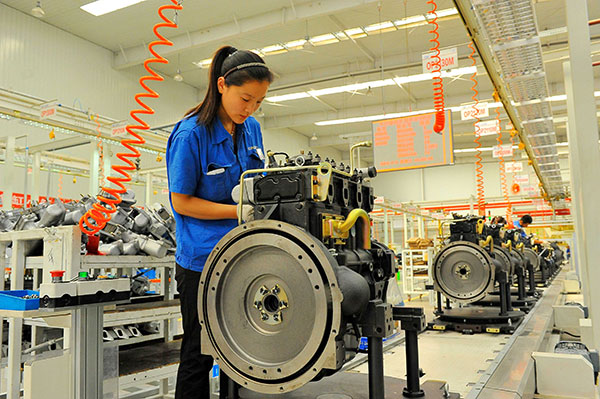

Workers assemble engines at a factory in Weifang, Shandong province. [Photo/China Daily] |

The sluggish data reported by the National Bureau of Statistics on Friday was mainly driven down by the energy-and commodity-intensive industries with problems of overcapacity, including oil, steel and coal.

But the high-tech manufacturing industry achieved 14.2 percent year-on-year profit growth. Profits in the equipment manufacturing industry increased by 8.6 percent, the NBS said.

In the first 10 months, the country's industrial profits shrank 2 percent from a year earlier, reaching a total of 4.87 trillion yuan ($785 billion).

Under the economic slowdown pressure, the sales revenue of industrial production dropped fast, while increased costs also squeezed net income, said He Ping, a senior economist at the bureau.

A series of economic indicators in October suggested that the world's second-largest economy has not yet seen any rebound after GDP hit a six-year low of 6.9 percent in the third quarter, although the government has made efforts to support growth through both monetary and fiscal measures.

On Friday, the onshore Chinese yuan's daily trading reference exchange rate slipped to 6. 3915 per US dollar, the lowest since Aug 20, influenced by expectations of depreciation in offshore markets amid the slowdown pressure.

Chen Kaiyang, a senior manager with the Bosera Asset Management, said: "Traditional industrial companies and small businesses will face greater challenges to survive during the economic restructuring process, plus the overall economy is continually slowing down."

Debt defaults may increase, especially at the year end when the financing market faces tightening liquidity, and investors should be aware of the potential systematic risk, said Chen.

According to a statement from Shanghai Clearing House, up to Nov 20, at least 43 companies had abandoned their plans to issue bonds that could raise a total of nearly 46.7 billion yuan. Most of those companies were from the steel and cement production industries.

The Chinamoney website, managed by the People's Bank of China, said that at least six companies have defaulted on yuan-denominated corporate bonds so far this year.

The website also showed that more Chinese companies are struggling to repay bonds including Jiangsu Lvling Runfa Chemical, a fertilizer maker, and Sichuan Shengda Group Ltd.

Related Stories

China issues pro-trade customs measures 2015-11-26 07:54

Moody's: Falling Chinese steel demand to drive capacity cuts, restructuring 2015-11-23 09:59

Leading economist upholds service industry for growth 2015-11-23 09:55

Chinese economy blessed with huge staying power 2015-11-21 10:32

China shifting to nation of consumers: expert 2015-11-20 09:55

Today's Top News

Beijing to adopt world's strictest emissions standard

Erdogan-Putin meeting possible: Turkish presidency

China to spend $438b on new rails over the next five years

Xi urges breakthroughs in military structural reform

Chinese play growing part in online shopping

Surviving Russian pilot says no warning from Turkey

Xi to attend Paris climate conference

Putin: Turkey's downing of jet 'stab in the back'

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|