Shanghai's wealthy pay 15% of Chinese life insurance premiums

Updated: 2015-10-13 15:37

By Shi Jing(chinadaily.com.cn)

|

|||||||||||

|

|

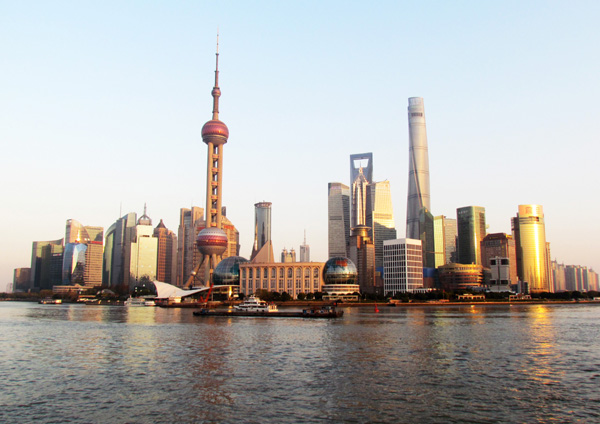

The Bund and its many buildings are one of Shanghai's most photographed sites. [Asianewsphoto by Bao Guoxin] |

The total money that Shanghai rich people with a personal wealth of at least 10 million yuan have invested in life insurance takes up 15 percent of total life insurance premiums in China.

The survey studied 1,119 Chinese people with high net worth, among which 12.7 percent live in Shanghai. The city is now home to the third largest group of high net worth individuals in China. The number of rich people with a personal wealth of at least 10 million yuan grew 22,000 this year to reach 181,000. These people's total assets have amounted to 1.24 billion yuan, taking up 20.5 percent of all the assets possessed by Chinese rich people.

High net worth individuals in Shanghai have a higher willingness to invest in life insurance in the next three years, with 73 percent of them expressing the intention of doing so. Medical insurance comes in second in terms of popularity, with 68 percent willing to invest in it.

However, insurance policies with a premium of 2 million yuan and above each still have a very low penetration rate, reaching only 3 percent among the billionaires in Shanghai. Less than 30 percent of them have some basic understanding of these large-premium policies.

Household annual premiums among rich Shanghai families reached 164,000 yuan, which is 15,000 yuan more than the national average.

Rich people in Shanghai are more willing to try new medical institutions and services in the next three years. Private hospitals will become the most popular medical institution in the future. Some 61 percent of the polled billionaires said they would choose Chinese private hospitals while 58 percent of them prefer those from overseas.

Although private physicians are not that popular at present, the rich people interviewed in China have shown great interest in them, as half say they will start this service within the next three years.

Meanwhile, some 40 percent of the respondents said they will also give overseas medical services and online medical services a chance in the future.

Related Stories

Life insurance pricing mechanism liberalized 2015-09-29 07:30

Insurance regulator to gain increased power 2015-09-23 15:15

Chinese insurers set to continue outbound M&As: Moody's 2015-09-22 15:15

Internet giant steps into life insurance 2015-09-03 10:41

China promotes commercial insurance for servicepeople 2015-08-03 10:17

Today's Top News

China foreign trade decline narrows in September

Director 'stupefied' by Academy's decision to drop Wolf Totem

Germany continues border controls until November: media

Islamic State is prime suspect in Turkey bombing, as protests erupt

Opinion: Opportunity knocks for EU and China over next five years

Yuan rises for 7th day in a row, highest level since August

Reforms spark legal brain drain

High-tech zones up the game

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|