Big picture needed on GDP growth

Updated: 2015-09-26 09:20

By Chen Jia(China Daily)

|

|||||||||||

|

|

Workers reinforce a bridge on the Yangtze River in Jiujiang, Jiangxi province. [Photo/China Daily] |

In response to analysts' and media questions about the reliability of China's economic data, a government spokesman said on Friday it is no longer appropriate to use only the old indexes to measure the country's performance during its rapid transition.

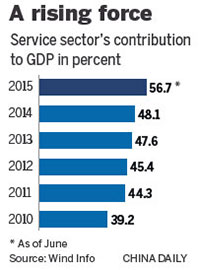

This is because, for the first time, the service industry has been contributing a larger share to China's GDP growth than the manufacturing industry, said Sheng Laiyun, a senior official of the National Bureau of Statistics.

People wouldn't get the full picture of the Chinese economy if they still tried to size it up by using such indexes as the increase in loan supplies, in electricity generation, and in cargo throughput, said Sheng, who joined the NBS after obtaining a doctoral degree in economics.

Based on the economy's full reality, the NBS said that China has managed to achieve a GDP growth of 7 percent in the first half of the year and is capable of maintaining roughly that growth rate in the third quarter.

In the first half, the service sector contributed 53.4 percent of China's total growth, compared with a contribution of 43.5 percent from the industrial sector, primarily manufacturing, and the rest from agriculture.

By contrast, in the same period last year, the service sector contributed 47.3 percent, while the industrial sector was still powerful enough to contribute 49.5 percent.

Sheng said the trend is accelerating that China's model of economic growth is transforming from an industry-driven model into a service-led one, and thus some traditional indexes are becoming less accurate and less representative.

The steady expansion of the service sector will help China achieve its growth target in the third quarter, Sheng said, adding that a 6.5 percent growth in GDP would be the lower limit of the Chinese government's tolerance.

For instance, he said, it would be wrong "to only use data about electricity consumption for the growth forecast, because electricity consumption in the service sector is about 20 percent that of the industrial sector".

He noted that some people said China's report of 7 percent GDP growth in the first half failed to match the country's electricity consumption, which showed a year-on-year increase of only 1.3 percent.

However, Sheng warned that China may face more complications, most noticeably in that the stock market rout in July and August may delay China's overall recovery, which the government had expected to emerge in the third quarter.

A research note from Barclays Capital said, "Developments since the second quarter continue to suggest China is experiencing a structural slowdown while facing strong cyclical headwinds.

"Meanwhile, the retail and service sectors remain the brighter spots, featuring the economic transition."

According to data from the NBS, retail sales growth was 10.8 percent in August, with online sales standing strong at an increase of 36.5 percent year-on-year. The service sector, including financial services, has been growing at a robust pace, registering 8.4 percent in the first two quarters, versus 6.1 percent for the industrial sector.

Frederic Neumann, an economist at HSBC Bank Holdings, said: "Sluggish global trade has largely been blamed on wobbly growth in China. But, if the country's shipments are softening, too, then something else must be going on.

"For all (critics') recent swagger, developed markets are hardly firing on all cylinders. So, don't just blame China. Everyone's got a role to play in keeping the world economy right side up," he said.

Related Stories

Bank of China forecasts 7% growth rate in fourth quarter 2015-09-24 09:36

GDP slowdown cloud has a silver lining: retail spending 2015-09-23 08:05

Growth target 'can be met' despite lower projections 2015-09-23 07:34

Chinese think tank predicts 6.9% GDP growth for 2015 2015-09-22 11:09

Slow growth may spur more support 2015-09-14 06:45

Today's Top News

Xi, Obama outline joint vision to combat global climate change

Xi will get a bigger welcome in UK

China to create national carbon-trading market

Xi, Obama take aim at cybertheft

Experts weigh in on President Xi's visit to the US

Diplomats, officials attend Confucius Institute's Open Day in Beijing

China has one of the lowest homicide rates in the world

Premier emphasizes innovation, entrepreneurship on Henan trip

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|