Rumoured easing may not aid property sector

Updated: 2014-09-23 14:09

By Xin Zhiming(chinadaily.com.cn)

|

|||||||||||

China’s major banks may ease mortgage lending to stabilize the real estate sector and the economy as a whole.

But the move may prove ineffective as the maturing property market is trending down and may at best only postpone property price correction.

According to rumour, yet to be confirmed by the central bank, those who have repaid their mortgage can enjoy low rates if they want to buy a new apartment. Down payments may also be reduced for those already owning an apartment to buy more.

Existing policies have restrictions on people buying a second property.

The new policy reflects both the predicament of the real estate sector and the concerns of policymakers about continuing real estate woes.

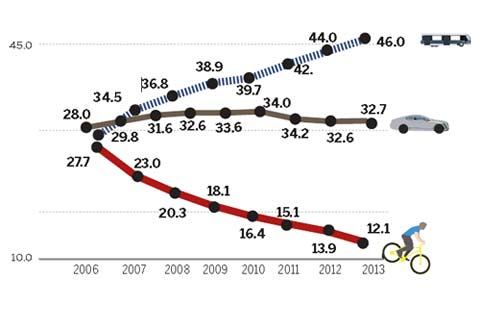

Reuters’ calculations show that the average new home price in China dropped by 1.1 percent last month from July, compared with a previous fall of 0.9 percent.

Since China’s home prices peaked in 2013, prices have fallen in almost all major cities, with potential buyers becoming increasingly hesitant to commit.

Weakening economic growth has led to falling demand and some developers are trapped in financing bottlenecks as banks become more cautious.

The rumour, if true, suggests policymakers do not want to see drastic home price corrections as a crisis in the sector would spread to other industries and further drive down the economy. Policymakers have repeatedly made it clear that they neither want home prices to continue to rise nor allow prices to spiral downward.

Given the unaffordable costs of any massive stimulus, the authorities have also made it known that it will only resort to “targeted” stimulus measures to keep the economy going and ruled out the possibility of rolling out a large-scale stimulus program as it did in late 2008.

Reflecting that selective approach, the People’s Bank of China last week offered to lend $81 billion to big banks — rather than cutting lending rates or the reserve requirement across the board — to allow banks to lend more to the real economy.

While it is impossible for the authorities to initiate any big policy change to bail out the property sector, it could fine-tune restrictive policies to increase housing demand.

However, the latest policy easing, if rumour should become fact, will not work in stimulating demand as the downward trend has become entrenched.

China’s real estate boom has lasted for at least 10 years, with prices in some localities having risen by about 10 times. It is now unaffordable for ordinary, first-time buyers to purchase a home.

For those already owning an apartment but wanting to buy a larger one, falling prices would make them hesitant, unable to see when prices would hit a trough. Once the downward trend begins it is hard for it to be reversed.

For policymakers and developers alike, the best scenario would be that thanks to the government’s repeated mini-stimulus, the real estate market can be stabilized and prices do not fall drastically to threaten overall economic stability.

Related Stories

Chinese property developer says ready to partner South Africans in business 2014-09-19 10:21

China's property investment cools in August 2014-09-13 17:39

New regime paves the way for property tax 2014-09-07 14:26

Property price to rise for another 3 to 5 years 2014-08-29 10:15

Today's Top News

President Xi reassures HK of stability

Russia taps China for meat

China vows $6m for climate plan

Should Beijing help fight IS?

Let Mideast people solve their region's problems

Iraq situation demands China to engage

Ukrainian troops, rebels start creating buffer zone

China, US seek ways to benefit from carp

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|