Starting now, bank loans easier to get

Updated: 2014-07-01 06:56

By GAO CHANGXIN (China Daily)

|

|||||||||||

In comparison, trusted loans grew just 341 billion yuan in the first five months, only one-third of the 1.1 trillion yuan lent during the same period last year.

The regulatory modification comes after Beijing sent its strongest pro-growth signal yet this year during an executive meeting of the State Council, China's cabinet, on May 30, when Premier Li Keqiang vowed to "step up the financial industry's support to the real economy".

|

|

The cuts helped revive economic activity, with the preliminary HSBC Holdings Plc manufacturing Purchasing Managers Index coming in at a seven-month high of 50.8 in May, the first reading above 50-the line dividing expansion and contraction-this year.

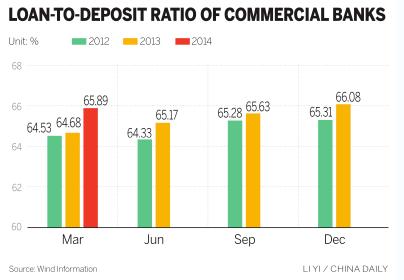

According to the CBRC statement, foreign currency loans and deposits will no longer be included in the calculation of lenders' loan-to-deposit ratio. They will be monitored separately, which the CBRC said will prevent "regulatory arbitrage through local-foreign currency conversion".

Another change to the loan calculation is that loans supported by lenders' non-puttable bonds with less than one year to maturity will be taken out of the equation.

Meanwhile, certificates of deposit, a type of large-sum term deposit whose interbank trading was made available this year in China, will be added to the equation when calculating the ratio.

Related Stories

Banking profits hit $920b as Chinese lenders boom 2014-06-30 14:04

PBOC plans annual reserve ratio reviews 2014-06-26 07:03

Liquidity concerns abate for most Chinese lenders 2014-06-18 08:34

Lenders 'stable' amid economic rebalancing 2014-06-18 07:11

China's targeted RRR cuts boost economic restructuring 2014-06-03 14:00

Targeted easing the first step to aid economy 2014-06-03 14:38

Today's Top News

Palace Museum feeling the squeeze of visitors

Myanmar pagoda replica given to China

US sends 300 more troops to Iraq over concerns

Hong Kong at the crossroads

Japan pushes for military reform

China's move to domestic software pressures foreign companies

Chinese firm sues Apple for trademark infringement

Emperor penguins waddling to extinction, study finds

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|