Less bullish on bullion: Gold bar demand dives

Updated: 2014-05-07 07:31

By LI JIABAO (China Daily)

|

|||||||||||

In addition to a growing middle class, rising real incomes, a deepening pool of private savings and rapid urbanization across China suggest that the outlook for gold jewelry and investment demand in the next four years will remain strong, the report added.

Jeffrey M. Christian, managing partner of CPM Group LLC in New York, said China's demand will decide American and European investors' mindset and confidence in the global gold market.

But China does not have a big influence on gold pricing despite the astonishing increase in gold demand since the liberalization of the gold market in the late 1990s and the subsequent offering of gold bullion products by local commercial banks starting in 2004.

"The gold price will remain weak in the near future, while China's gold industry will be confronted by great challenges. Domestic enterprises must join hands to combat difficulties, including maintaining healthy competition, advancing technology for innovation and further reducing costs," said Song Xin, president of the China Gold Association.

On Tuesday, the association, together with the CPM and Jingyi Gold Co Ltd, launched the Chinese version of the CPM Gold Yearbook 2014.

The yearbook said that while the macroeconomic environment remains a leading factor affecting gold demand, investors' attitude and faith are what is most important.

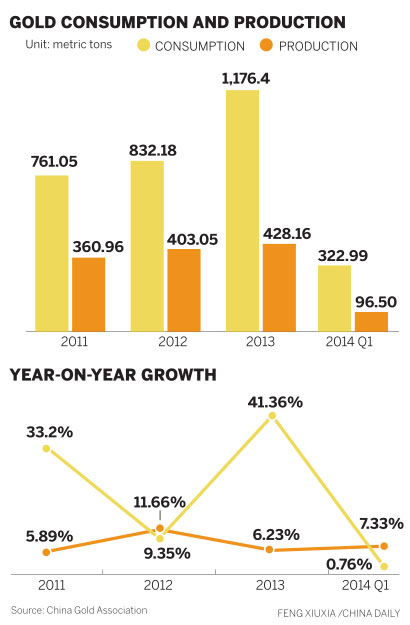

In the first quarter of this year, China's gold production reached 96.50 tons, with an increase of 7.33 percent from a year earlier. Breaking down those numbers, mine production rose 5.88 percent to 79.15 tons, while secondary nonferrous output rose 14.47 percent to 17.35 tons.

|

|

|

Related Stories

Gold rush in Henan 2014-02-24 13:58

China overtakes India as top gold consumer 2014-02-24 10:19

China world's biggest gold market 2014-02-18 22:24

Chinese gold retailer to buy US oil operator 2014-02-17 15:33

China's gold consumption surges 2014-02-11 16:53

Precious metal output and purchasing soar 2014-02-11 01:38

Today's Top News

EU: No armed intervention in Ukraine

Chinese premier visits Nigeria

Court to rule on Yingluck in Thailand

Travellers to Malaysia drop

Chinese to US grad schools drop

Ukraine moves special forces to Odessa

Slovenian PM resigns

Disclosure of military secrets becoming bigger risk

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|