NZ finance chiefs welcome Chinese currency trade agreement

Updated: 2014-03-19 11:03

(Xinhua)

|

|||||||||||

WELLINGTON - New Zealand finance officials on Wednesday welcomed an agreement allowing direct trading of the New Zealand and Chinese currencies, saying they would build on the growing bilateral trade and investment ties.

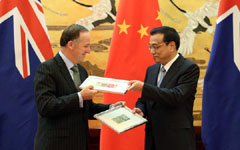

Finance Minister Bill English said the agreement announced by New Zealand Prime Minister John Key and Chinese Premier Li Keqiang in Beijing late Tuesday was a significant and welcome step forward in the economic relationship with China.

"It will make doing business with China easier by reducing the costs of converting between the two currencies, and it will further stimulate our already strong trade and investment links," English said in a statement.

|

|

|

|

Last year alone, trade in goods between New Zealand and China increased by more than 25 percent to 18.2 billion ($15.69 billion), making China New Zealand's top destination for goods exports.

The New Zealand dollar was only the sixth currency to be traded directly with China's Renminbi, following the US dollar, the Japanese yen, the Australian dollar, the Russian rouble and the Malaysian ringgit.

New Zealand Treasury secretary Gabriel Makhlouf said the agreement followed considerable work by the New Zealand Treasury and the People's Bank of China.

"The Treasury has been discussing and finalizing the details of this agreement with Chinese officials, the Reserve Bank of New Zealand and New Zealand financial institutions since September last year," Makhlouf said.

"There are several economic benefits we see flowing from direct dollar-Renminbi trading. Over time we expect increased integration of Chinese and New Zealand financial markets, reduced transaction costs, and improved efficiency of trade and cross-border capital flows," he said in a statement.

Prime Minister John Key said after meeting Premier Li Keqiang at the Great Hall of the People that the negotiations on direct currency trading were begun on the margins of the Bo'ao Forum in April 2013.

The New Zealand government was working with New Zealand banks, other financial institutions, and exporters and importers who trade with China, to raise awareness of the benefits of pricing in the two currencies and how direct trading could help.

The Australian-owned Westpac bank announced Wednesday that it had received approval from the People's Bank of China to act as a "market maker" for direct trading of the two currencies on the China Foreign Exchange Trading System.

The license allows direct interbank trading of the currencies, meaning reduced transactional costs and over time increased liquidity to currency deals between New Zealand and Chinese trading partners.

Related Stories

Direct currency trading begins with New Zealand 2014-03-19 00:08

Chinese audit team to visit NZ dairy producers 2014-03-13 08:27

Chinese company plans New Zealand's highest office building 2014-02-12 13:52

NZ lamb goes to pot in China 2014-02-07 09:18

China warns consumers after Fonterra cream recall 2014-01-14 16:57

China demand drives NZ into top 3 forestry exporters 2014-01-13 14:28

Today's Top News

Thai radar may have detected missing jet

Ukraine rejects Crimea treaty

Tourists to be refunded for smog

Chinese authorities upgrade food waste fight

First lady's visit to boost goodwill

Chinese authorities upgrade food waste fight

Xi to sign flurry of deals in Europe

Li vows not to give up plane hunt

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|