Comeback kid keeps things simple

Updated: 2014-02-13 08:27

By Hu Yuanyuan (China Daily)

|

|||||||||||

In the eyes of international rating agency Moody's Investors Service, Sunac's active land acquisition is credit-negative, despite the company's better-than-expected contract sales.

"A sustained momentum with respect to acquisitions could eventually weaken the company's liquidity position and raise its debt leverage which could in turn affect its corporate family rating and stable outlook," said Franco Leung, a Moody's assistant vice-president and analyst.

Leung believes the company's aggressive bidding for new projects could increase the risk of a profit margin squeeze and reduce its flexibility in pricing over the next one to two years, if the market undergoes a correction.

The land cost of its latest Beijing project, at 73,100 yuan per sq m, was dramatically higher than Sunac's historical average land cost of around 6,000 yuan per sq m as of the end of 2012, according to Moody's.

Nonetheless Sun has his own philosophy. Different property developers may have different judgments and strategies for buying land parcels. For Sunac, an important indicator is the gap between the land cost and the potential selling price.

"If the land cost is 73,000 yuan (per sq m) and the selling price is only 90,000 yuan, then it will definitely be a failure. But if we are confident that the selling price could reach 150,000 yuan, then the high cost could pay off," Sun explained.

According to Sun, the company spent several years researching that particular land parcel and decided the final price is within their expectations.

"During the final bidding round, four property developers' bidding prices all exceeded 70,000 yuan (per sq m)," Sun added.

Xie Zhigang, chairman of Beijing Vereal Investment Holding Group, holds a similar viewpoint.

"Given the superior location of the land parcel, the cost is acceptable, especially for a luxury product," said Xie.

Sunac maintains a rigorous stricture over land purchases. This is partly because of lessons learned from Sun's first property business - Sunco - which failed mainly because of the broken cash flow resulting from excessively fast expansion.

The key to the development of real estate companies' business and risk management, Sun stressed, is to acquire quality land parcels at an appropriate price.

Risk control is the primary factor that Sunac takes into consideration when evaluating land parcel purchases. The group has the final say based on the overall cash flow, leverage rate and the company's strategic arrangements.

Sunac examined 342 land parcels across the country in 2013, eventually buying 19 of them

Related Stories

Property turnover slumps during Lunar New Year 2014-02-07 16:35

Property construction still rising - but so is caution 2014-02-07 14:08

Property buyers scouring the world in diversification drive 2014-01-28 07:54

Govt must protect people's property 2014-01-27 07:59

China's 2013 property investment up 19.8% 2014-01-21 09:13

Developers under pressure to reduce glut of new homes 2014-01-08 07:06

Today's Top News

China's lunar rover comes back to life

No casualties reported in Xinjiang quake

Embassy in talks over arrest

Abe's view on history rapped

Prostitution crackdown expands in Guangdong

New visa policies a blessing for Chinese travelers

Chinese consume too much food from animals

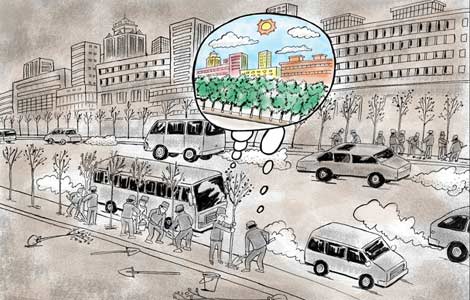

Beijing low on list of green cities

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|