China's Autohome shares soar over 75% in US IPO

Updated: 2013-12-12 09:13

(Xinhua)

|

|||||||||||

NEW YORK - China's Autohome Inc, an auto information provider, saw its shares soar over 75 percent in its debut on the US stock market on Wednesday.

Autohome closed at $30.07 per share on the New York Stock Exchange, up 76.88 percent from its initial public offering (IPO) price. Its ticker symbol is ATHM.

The company announced Tuesday that it has priced its IPO of 7,820,000 American Depositary Shares (ADSs), each ADS representing one Class A ordinary share of the company, at $17 per ADS with a total offering size of $132.94 million.

"The Autohome team will not have any change before and after the IPO. Going public is only part of the growth of an enterprise, " James Qin, chief executive officer of Autohome, said on Wednesday.

From the IPO, Autohome gets not only capitals but also a better employer brand and an opportunity for it to grow stronger in the U S market which has more regulations and stricter institutional investors, Qin said.

As a public listed company, information disclosure is a very important issue for the company, Qin said, adding that corporate governance and internal control are also challenges the company is facing.

"We have strategies and plans, the challenge is if we could execute them well," he said.

Autohome is the leading on-line destination for automobile consumers in China. Through its two websites, autohome.com.cn and che168.com, the company provides comprehensive, independent and interactive content to automobile buyers and owners.

Australia's telecom giant Telstra Corp. Ltd. is the biggest shareholder in the Chinese company.

Related Stories

Autohome on track for NYSE listing by mid-month 2013-12-05 12:29

Auto website Autohome sets terms for $102m IPO 2013-12-02 17:42

Aussie Telstra to list Autohome on NYSE 2013-11-05 14:18

Today's Top News

Overseas investment set for 'golden era'

No better way to protect US than surveillance

Central bank may tighten credit

Talent plan to unleash creativity

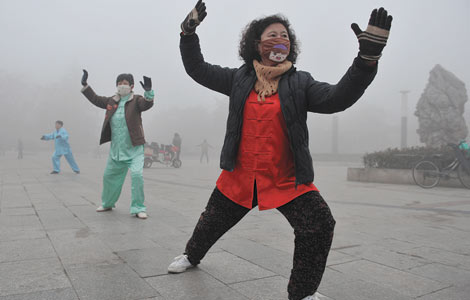

Pilots must qualify to land in haze

'Containing China' a Japan's strategy

Perks targeted in anti-graft drive

China announces holiday dates for 2014

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|