Learning from Malaysian stock market

Updated: 2013-12-03 09:27

By Elaine Tan (China Daily)

|

|||||||||||

Troubled HB Global reported a 26.11 million ringgit net profit for the financial year ended 2012, representing a more than 76 percent decline from the previous year. Both China Ouhua Winery and K-Star Sports have gone from strong profit positions to losses within a year.

Companies like China Stationery and China Automobile Parts are in the black and reporting improvements in profit; yet they are trading well below their earnings per share.

The Chinese are understandably frustrated by what appears to be sweeping discrimination.

"Investors should not paint with broad strokes and assume that all Chinese companies are the same. China Stationery is a stock with strong fundamentals, yet to be recognized by investors," said Chan Fung, China Stationery's executive chairman.

Wu of Xingquan International echoed that view.

"There are also many good China-based companies listed in New York and Singapore. We hope the investment community in Malaysia will also be able to distinguish between good and not so good China-based counters to invest wisely."

When contacted, Bursa Malaysia declined to comment on specific stock performance.

"At times, the stock price may not reflect the fundamental performance of a publicly listed company due to certain factors such as visibility among the investment community and the composition of the company's investor base," Bursa Malaysia said.

It advised the companies to undertake more active investor relations activities as well as direct engagement to keep investors informed, adding that the exchange is also constantly profiling its listed companies to the investing community.

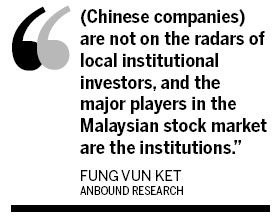

"They can do more to reach out to investors," agreed Fung from Anbound Research. "For example, they should make more announcements about their activities and operations in China on Bursa Malaysia."

Fung added that the companies need to also strengthen their local presence.

"They do not have significant business, assets or investments (in Malaysia), which does not go down well with local investors. At the least, they should export their products here to create awareness," Fung said.

Although rumors of delisting and going private have circulated, the Chinese appear to be in it for the long haul.

"We will maintain our listing," said Wu. "The depressed stock prices of China-based companies are due to a perception issue, not just in the local market but also globally."

Maxwell International has the same opinion. Its chief financial officer Tan Swee Song told StarBizWeek they will not give up on attracting investors.

For now, the icy treatment by Malaysian investors appears not to have put a dampener on Chinese companies seeking listing in Malaysia. Bamboo flooring company Kanger International Bhd is on track to becoming the 10th Chinese company to go public on Bursa Malaysia.

"The Malaysian market is still attractive," said Mercury Securities' Tham.

Related Stories

Malaysia welcomes Chinese investment 2013-10-25 20:34

Malaysia has much to offer investors 2013-10-05 07:39

China, Malaysia to expand trade ties 2013-10-04 07:18

More Chinese investment to Malaysia expected 2013-10-03 11:33

Stock market can't meet cash call 2013-09-30 08:07

Stock market needs effective regulation 2013-09-18 07:49

Today's Top News

EU imposes definitive measures on solar panels

EU-China trade disputes need 'rational' tack

China-UK collaboration is about time: President Xi

Biden's Asian visit under pressure

FTZ OKs offshore accounts

Survey shows Chinese holiday preference

Pandas to arrive Brussels in spring

China's rise 'an opportunity' for UK

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|