China's new reforms must breach vested interests

Updated: 2013-11-04 17:28

(Xinhua)

|

|||||||||||

BEIJING -- When Chen Feng served passengers on his airline's first flight from Haikou to Beijing on a sunny day in May 1993, he had no idea how far Hainan Airlines would fly.

The startup, founded through joint stock reform, was a relatively new phenomenon in the country's aviation industry at the time, which was dominated by state-owned airlines. Later that year, China would start reforming state-owned companies after it endorsed the "socialist" market economy in a key Party meeting in 1992.

Two decades on, HNA has become the country's fourth-biggest airline, with more than 330 planes and total assets of nearly 360 billion yuan ($59 billion). However, Chen said China's market, including the aviation industry, is still not free enough. He is not alone.

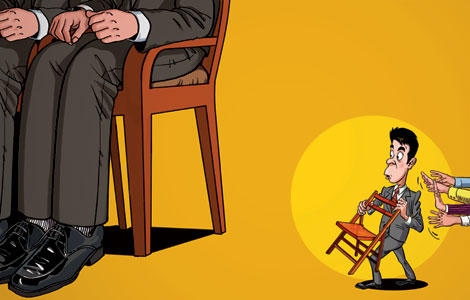

The past 35 years of reform and opening up have fueled the growth of a raft of companies like HNA and the proliferation of self-made rich. Yet, some beneficiaries of reform have started to oppose further changes in the country, becoming "powerful vested interests" that obstruct China's new reforms.

Pattern of vested interests

"Compared with 20 years ago, now it is very easy to tell who is rich and who is poor. In the past, we were all poor. A pattern of vested interests has come into being. The yawning rich-and-poor gap stands out among the problems caused by the 'entrenched interests,'" said Chi Fulin, head of the China Institute for Reform and Development, a Hainan-based think tank.

The Forbes 2013 list of China's richest showed that the wealth of the top 100 totaled $316.45 billion, while around 100 million people earn less than 2,300 yuan per year in rural areas, according to official data.

This is just a snapshot of China's unbalanced distribution of wealth. In fact, the gaps are widening between city and countryside, industries, rich and poor and among different regions, said Wang Yukai, a professor at the Chinese Academy of Governance.

Zhou Tianyong, a researcher at the Party School of the Communist Party of China Central Committee, pointed out that the government and state-owned companies and banks are taking the lion's share of interests. Some key industries, such as energy, finance and telecommunications, are monopolized by state-owned enterprises.

The job preferences of young people provide a further glimpse into the reality. College graduates are least interested in being factory workers, while they identified civil servant jobs as the most sought-after positions, according to a poll launched this year by SINA.com, a major portal website in China. Another survey conducted by YJBYS.com, a recruitment website, showed that young people voted finance, banking and IT industries as the most desirable areas of work.

Meanwhile, the administrative approval system gives the government paramount powers, which can encourage bribery and spawn corruption, Zhou said.

Whenever HNA wants to buy a new plane or add flights, the company must ask for government permission.

"The market should have the final say, rather than the government," said Chen. "This way of doing things really needs reform."

Key of China's new reforms

Experts believe that the key to China's new reforms is not simply how to make the economic pie bigger, but to realize fair distribution.

Related Stories

HNA revenue set to soar 2013-04-30 23:58

HNA Group launches Urumqi Airlines with local govt 2013-02-27 22:02

HNA Group gets revenue of 120b yuan in 2012 2013-01-09 16:58

Bold deep-seated reforms 2013-11-04 10:34

Financial system reform 2013-11-04 07:14

Reform roadmap before key meeting 2013-11-04 00:29

Today's Top News

Chinese Premier Li seeks point of balance

Reform roadmap before key meeting

Intel leaks proved justified: Snowden

Cooperation needed in terror fight

Beijing to further boost visa-free stay

Shenzhou X crew awarded for outstanding service

US to file murder complaint against LAX shooter

China's non-manufacturing PMI rises in October

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|