China offers tax breaks for shantytown renovation

Updated: 2013-10-28 20:42

(Xinhua)

|

|||||||||||

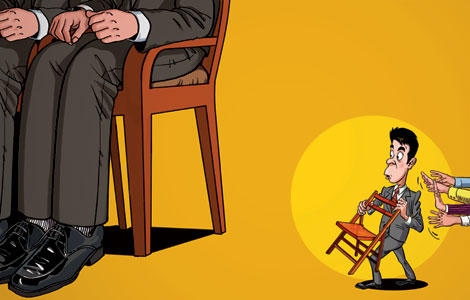

BEIJING - Enterprises involved in government-led shantytown renovation are eligible for tax breaks if they meet certain conditions, authorities announced on Monday in an effort to encourage participation in the project.

Renovation expenditures will be deducted from the tax base for enterprises engaged in government-organized redevelopment of remote mining and forestry areas that are short of public infrastructure, according to a circular released by the Ministry of Finance and the State Administration of Taxation.

The circular also specified other requirements for the tax break, including the number of households in the shantytowns and the state of the areas.

The policy will be retroactive to January 1, 2013.

Shantytown renovations are a crucial part of China's efforts to provide low-income urban residents with affordable accommodation while supporting growth amid an economic cool-off.

The country is aiming to renovate 10 million households in run-down areas over the coming five years, including 3.04 million this year.

Related Stories

China to tighten shantytown audits 2013-09-16 14:31

Fundraising limit raised for shantytown renovations 2013-09-09 16:42

Shantytown renovation projects start construction 2013-08-06 09:56

Beijing plans $81b shantytown renovation project 2013-07-30 07:15

Today's Top News

Storm wrecks havoc in S Britain, leaving 4 dead

'Prime time' for Chinese firms to invest in EU

China providing space training

Antiquated ideas source of Abe strategy

Women's congress aims to close gap

Accident in Tian'anmen kills 5

Media giant comes of age

Miscommunication source of conflicts

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|