Chinese overseas acquisitions

Updated: 2013-10-28 13:52

(cctv.com)

|

|||||||||||

For more on Chinese overseas acquisitions, we're joined in the studio by my colleague Wu Haojun.

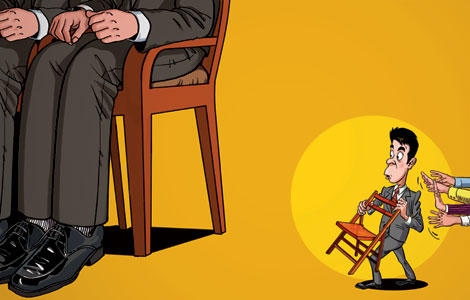

Wang: Investment by Chinese companies overseas is actually nothing new. But what seems to be new here is that we're seeing more and more private companies like Meijing Group buying assets that have nothing to do with natural resources. Tell us more about that.

Wu: Yes, you're absolutely right. It wouldn't be an overstatement to say natural resources was pretty much all that China cared about in terms of overseas deals in the past. BUT, as the Chinese economy matures, so do investment targets. Now we're increasingly seeing non-state owned companies in industries like technology, real estate and food buying assets overseas. Private or non-state-owned publicly listed companies first began exploring overseas deals en masse in 2004. 45 deals valued at 3.7 billion dollars were struck that year. So far this year, 238 overseas deals valued at over 24 billion dollars have been struck by China's private companies. Just to name a few, there's the 7.1 billion dollar acquisition of American pork producer Smithfield by Shuanghui. There's also personal-computer maker Lenovo, who said it's considering a bid for the struggling BlackBerry.

Wang: What can you tell us in terms of the government's involvement in these overseas acquisitions? Is it helping these private companies?

Wu: Well, it's fair to say that without government support, a lot of private companies simply wouldn't have been able to pull off these deals. Last year, 10 government departments jointly issued what they called "opinions" about actively encouraging private companies to make acquisitions abroad. This included one detailed regulation which relaxed certain aspects of foreign exchange control, which is tied to outbound investments. And these opinions had a clear impact. Analysts point to Shuanghui's takeover of Smithfield as the best example of this. The State-owned Bank of China was quick to offer up 4 billion dollars of financing. And this isn't an isolated case. The Industrial and Commercial Bank of China provided a total of 15.8 billion dollars in loans, just for the first half of this year, to finance overseas acquisitions by private companies.

Find more in

Related Stories

Overseas M&A deals on the rise 2013-10-16 07:05

Jinzhou enterprises lead overseas acquisition in Liaoning 2012-12-12 16:22

Chinese agricultural group seeks overseas acquisitions 2011-12-21 07:52

Overseas acquisitions by Chinese companies offer rewards and risks 2011-01-14 07:49

Today's Top News

Britain awaits hurricane-force 'St. Jude' storm

British media figures in phone-hacking trial

Mythbuster dispels fictions about China

Forum urges stable China-Japan ties

NSA spying hurts US diplomacy

Carrier rocket sent to launch base for moon landing

Requirements cut for business startups

Study shows PM1 most harmful

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|