Flag bearer for industrial revolution

Updated: 2013-10-25 12:57

By Chen Yingqun, Joseph Catanzaro and Song Wenwei (China Daily Africa)

|

|||||||||||

"The saying now is that you only make (the cost of) a bottle of still water on one ton of steel," Wang says.

In addition to investing heavily in Australian iron ore projects to lower raw material costs, Wang says the company plans to break into the logistics business. The move would see Shagang set up a logistics network that would keep its own transport overheads down for its steel division, while making additional profit from moving bulk goods, small freight and even mail.

That said, Wang says she is confident Shagang will continue to increase its output of steel products as it attempts to increase exports to foreign markets such as South Korea. But she conceded ever-shrinking margins mean steel is unlikely to be the most profitable arm of the company.

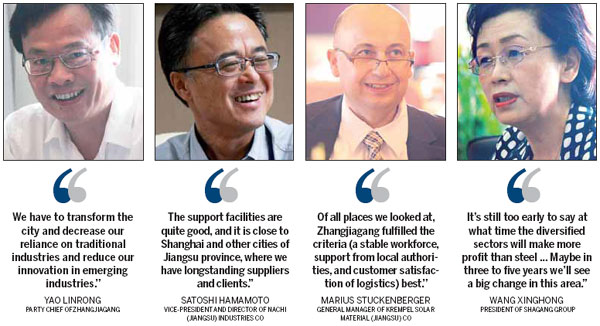

"It's a hard time for steel mills in China, so we must transform," Wang says. "In the future, we'll make bigger revenue in sectors other than steel. It's still too early to say at what time the diversified sectors will make more profit than steel. The logistics project we have is still under construction. Maybe in three to five years, we'll see a big change in this area."

An important part of Zhangjiagang's industrial revolution is attracting the right type of new investment.

Ma Xuefeng, deputy director of the Zhangjiagang Bureau of Commerce, says the city has picked companies with strong prospects. Between January and August this year, Zhangjiagang gave the green light to 29 new projects from companies from the emerging high-tech industries, reaping an investment bonanza worth $750 million, or 85.2 percent of the total investment during that period.

"Companies or projects that create pollution and use a lot of energy are finding it more difficult to do business here, even if it means a lot of money and job opportunities for the city in the short term," she says. "We prefer companies that are environmentally friendly, especially those dealing in new equipment, new energy and new materials."

Krempel Solar Material (Jiangsu) Co Ltd, a solar materials manufacturer and subsidiary of Krempel Group of Germany, is among the new breed of businesses to set up in Zhangjiagang.

Its general manager, Marius Stuckenberger, says it decided to invest after exhaustive research to find a location that would fulfill key criteria, including a stable workforce, support from local authorities, and customer satisfaction in terms of logistics.

"Of all places we looked at, Zhangjiagang fulfilled the criteria best," he says.

His sentiments were echoed by Satoshi Hamamoto, vice-president and director of Nachi (Jiangsu) Industries Co Ltd, which makes precision cutting tools, hydraulic equipment, industrial robots and automotive solenoids.

"It is not a big city, but it is clean and quiet, with a good security environment," he says. "Also, the support facilities are quite good, and it is close to Shanghai and other cities of Jiangsu province, where we have longstanding suppliers and clients."

Gu Weibin, director-assistant of the Zhangjiagang Economic and Technological Development Zone administration commission, says the city's economic hotspot now boasts more than 3,000 companies and an output value last year of 75 billion yuan.

Textiles manufacture, which used to account for half of the region's total output, now only accounts for 30 percent. In its place, the city's development zone has six companies that make robots and robotic components. To cater for the rise of this sector, a specialized industrial and research park is being built that officials predict will generate 6 billion yuan by 2016, and 20 billion yuan by 2020.

Hamamato says Nachi (Jiangsu) has opened a research division that aims to create cheaper robots, specifically tailored to the Chinese market. But one of the big hurdles, he says, is attracting and retaining skilled talent.

Yao, the city's Party chief, says about 90 percent of Zhangjiagang's 3,000 graduates every year choose to stay in the city, but some specialized skills still need to be imported.

Yao concedes the long road to industrial transformation is paved with difficulties, but the alternative route is the short one to ruin.

"Transformation is a slow process, and there are specific problems that arise in every process," Yao says. "But we are constantly looking for more efficient ways to help the city transform as quickly as possible."

Contact the writers at songwenwei@chinadaily.com.cn

Today's Top News

British media figures in phone-hacking trial

Mythbuster dispels fictions about China

Forum urges stableChina-Japan ties

NSA spying hurts US diplomacy

Carrier rocket sent to launch base for moon landing

Requirements cut for business startups

Study shows PM1 most harmful

Cold snap to sweep NE, N China

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|