M&A aims to buoy dairy sector

Updated: 2013-10-19 08:26

By Wang Zhuoqiong (China Daily)

|

|||||||||||

|

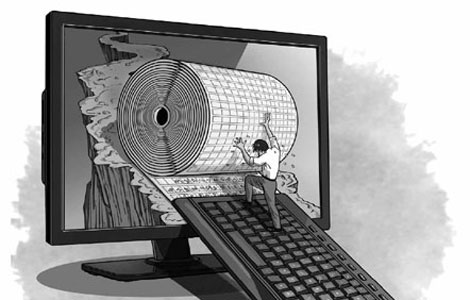

After the number of domestic dairy companies went down from 180 to 127, a new government plan for their further consolidation is likely to bring down the number to 50 in five years. The plan is expected to be released later this month. [Photo / China Daily] |

The Chinese dairy industry is expected to go from 127 producers to 50 in five years through mergers and acquisitions, an industry insider said.

A draft to foster consolidation among infant formula dairy producers will be released later this month, said Song Liang, a dairy analyst from the Distribution Productivity Promotion Center.

The hope is to cultivate three to five large dairy producers, each with revenue exceeding 5 billion yuan ($819 million) in five years, Song said.

The plan also aims to provide policy and taxation benefits to domestic dairy companies, he said.

Industry experts believe the plan will benefit domestic dairy companies that are dealing with competition from foreign rivals.

With government calls to merge domestic dairy players, the number of Chinese infant and toddler formula producers has gone from 180 to 127, and the number of brands decreased from 650 to about 500.

The consolidation also will bring stricter requirements for the production of infant and toddler formula milk powder.

According to the plan, by the end of 2015, dairy powder producers will have to upgrade to get approval to produce.

Smaller milk powder producers will be phased out if they can't meet the higher standard requiring high-cost upgrading, Song said

By 2015, of the 10 top producers, brand concentration should go to 65 percent from the current 45 percent, and milk powder companies should total about 80.

In five years, there will be three to five milk powder producers, each with revenue exceeding 5 billion yuan, with industry concentration at more than 80 percent and a total of 50 companies, according to the plan.

Song said the mergers and acquisitions will be aided by policy support and subsidies from central and local governments.

A high concentration of brands will improve the quality of supplies and lessen the differentiation among products, Song said.

According to Euromonitor, China's total dairy consumption has grown by 10 percent over the past five years, with premium dairy product consumption growing faster than the overall market and increasing its market share from 10 percent to 19 percent.

This has been due, in part, to continued consumer concern over food safety and increased health awareness.

Despite the strong growth, however, China's per capita liquid milk consumption is less than 10 kg per year, compared with 32 kg in Japan and 78 kg in the United States.

Related Stories

KKR returns to China's dairy industry with JV 2013-09-24 10:36

Fonterra plans for 2nd China dairy farming hub 2013-09-11 15:31

Bright outlook for Israel dairy firm acquisition 2013-09-04 10:29

Dairy companies see rising revenues 2013-09-03 08:40

Chinese dairy company to apply for Hong Kong IPO 2013-08-29 08:40

China urges NZ to resolve dairy crisis 2013-08-23 10:38

Today's Top News

No secret papers for Russia, says Snowden

China, EU move toward investment talks

Growth 'paves way for reforms'

Executives in Asia top the global pay league

Typhoon-ravaged Chinese city recovers from flooding

Mandatory student internships under fire

Shanghai to reduce PM2.5 20%

Workers' right to a rest stressed

Hot Topics

Lunar probe , China growth forecasts, Emission rules get tougher, China seen through 'colored lens', International board,

Editor's Picks

|

|

|

|

|

|